Question: i need all steps please 3. Your, assignment t is to prepare a ATCF replacement analysis study. A new machine is under consideration, it will

i need all steps please

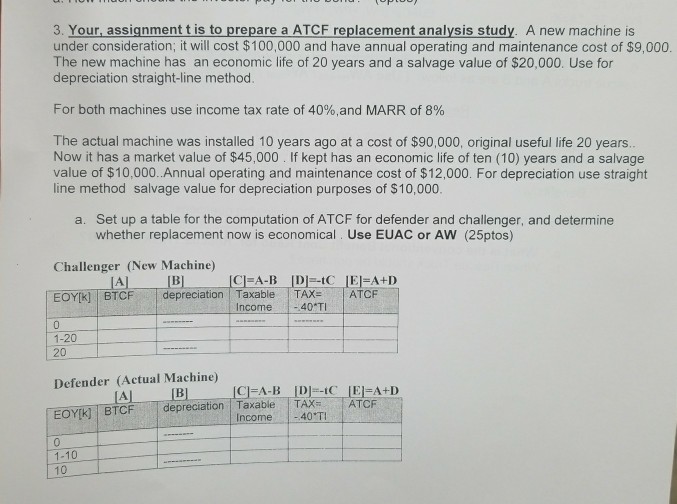

3. Your, assignment t is to prepare a ATCF replacement analysis study. A new machine is under consideration, it will cost $100,000 and have annual operating and maintenance cost of $9,000. The new machine has an economic life of 20 years and a salvage value of $20,000. Use for depreciation straight-line method. For both machines use income tax rate of 40%,and MARR of 8% The actual machine was installed 10 years ago at a cost of $90,000, original useful life 20 years.. Now it has a market value of $45,000. If kept has an economic life of ten (10) years and a salvage value of $10,000. .Annual operating and maintenance cost of $12,000. For depreciation use straight line method salvage value for depreciation purposes of $10,000. Set up a table for the computation of ATCF for defender and challenger, and determine whether replacement now is economical. Use EUAC or AW (25ptos) a. Challenger (New Machine) IA depreciation Taxable TAXATCF Income-40*TI 1-20 20 Defender (Actual Machine) EOYIK BTCF depreciation Taable TAX ATCF Income40TI 1-10 10

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts