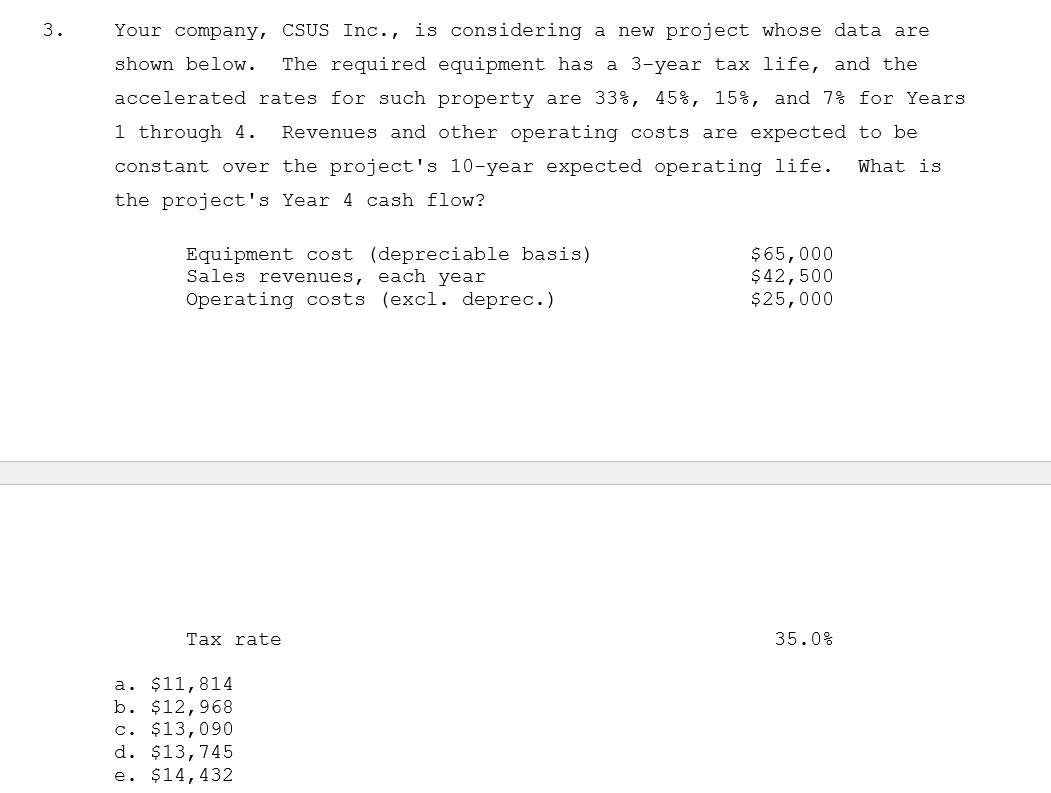

Question: 3. . Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and

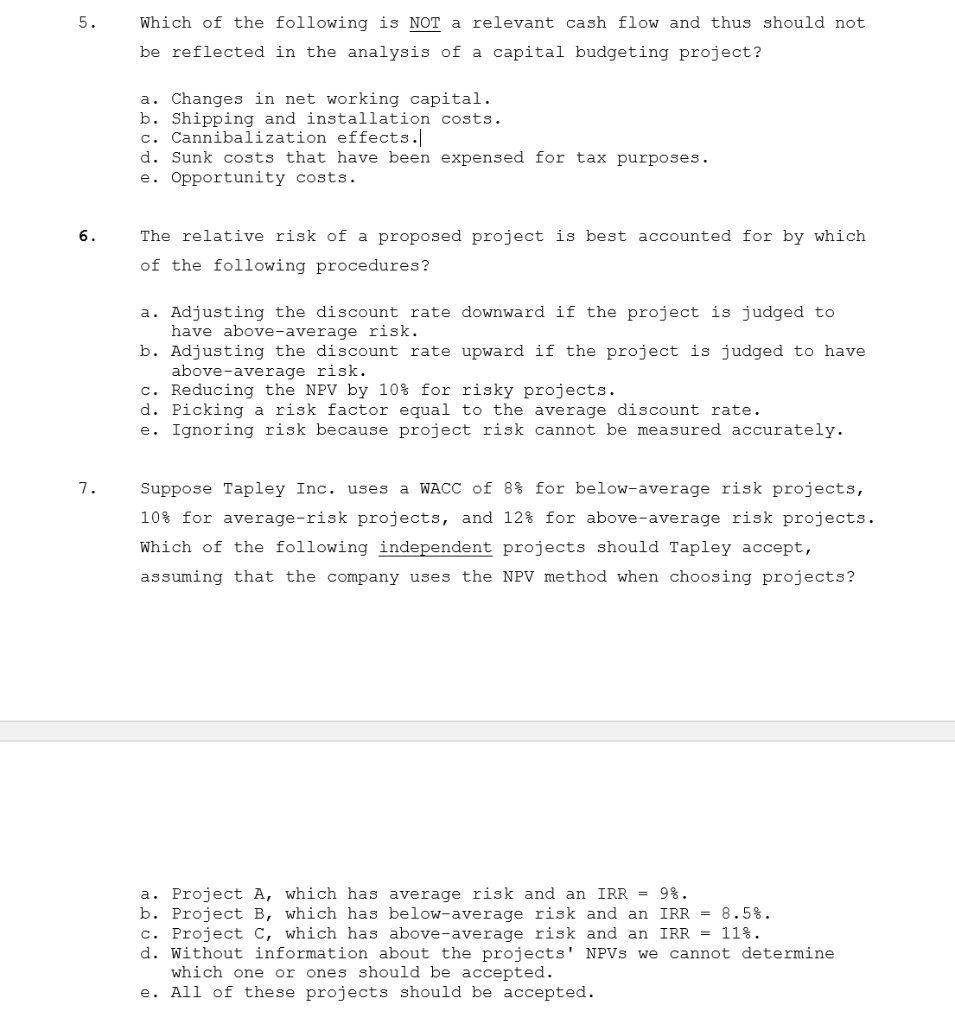

3. . Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33%, 45%, 15%, and 7% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10-year expected operating life. What is the project's Year 4 cash flow? Equipment cost (depreciable basis) Sales revenues, each year Operating costs (excl. deprec.) $ 65,000 $42,500 $25,000 Tax rate 35.0% a. $11,814 b. $12,968 c. $13,090 d. $13, 745 e. $14,432 5. Which of the following is NOT a relevant cash flow and thus should not be reflected in the analysis of a capital budgeting project? a. Changes in net working capital. b. Shipping and installation costs. c. Cannibalization effects. d. Sunk costs that have been expensed for tax purposes. e. Opportunity costs. 6. The relative risk of a proposed project is best accounted for by which of the following procedures? a. Adjusting the discount rate downward if the project is judged to have above-average risk. b. Adjusting the discount rate upward if the project is judged to have above-average risk. c. Reducing the NPV by 10% for risky projects. d. Picking a risk factor equal to the average discount rate. e. Ignoring risk because project risk cannot be measured accurately. 7. Suppose Tapley Inc. uses a WACC of 8% for below-average risk projects, 10% for average-risk projects, and 12% for above-average risk projects. Which of the following independent projects should Tapley accept, assuming that the company uses the NPV method when choosing projects? a. Project A, which has average risk and an IRR = 98. b. Project B, which has below-average risk and an IRR = 8.5%. c. Project C, which has above-average risk and an IRR = 11%. d. Without information about the projects' NPVs we cannot determine which one or ones should be accepted. e. All of these projects should be accepted

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts