Question: 25. Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the

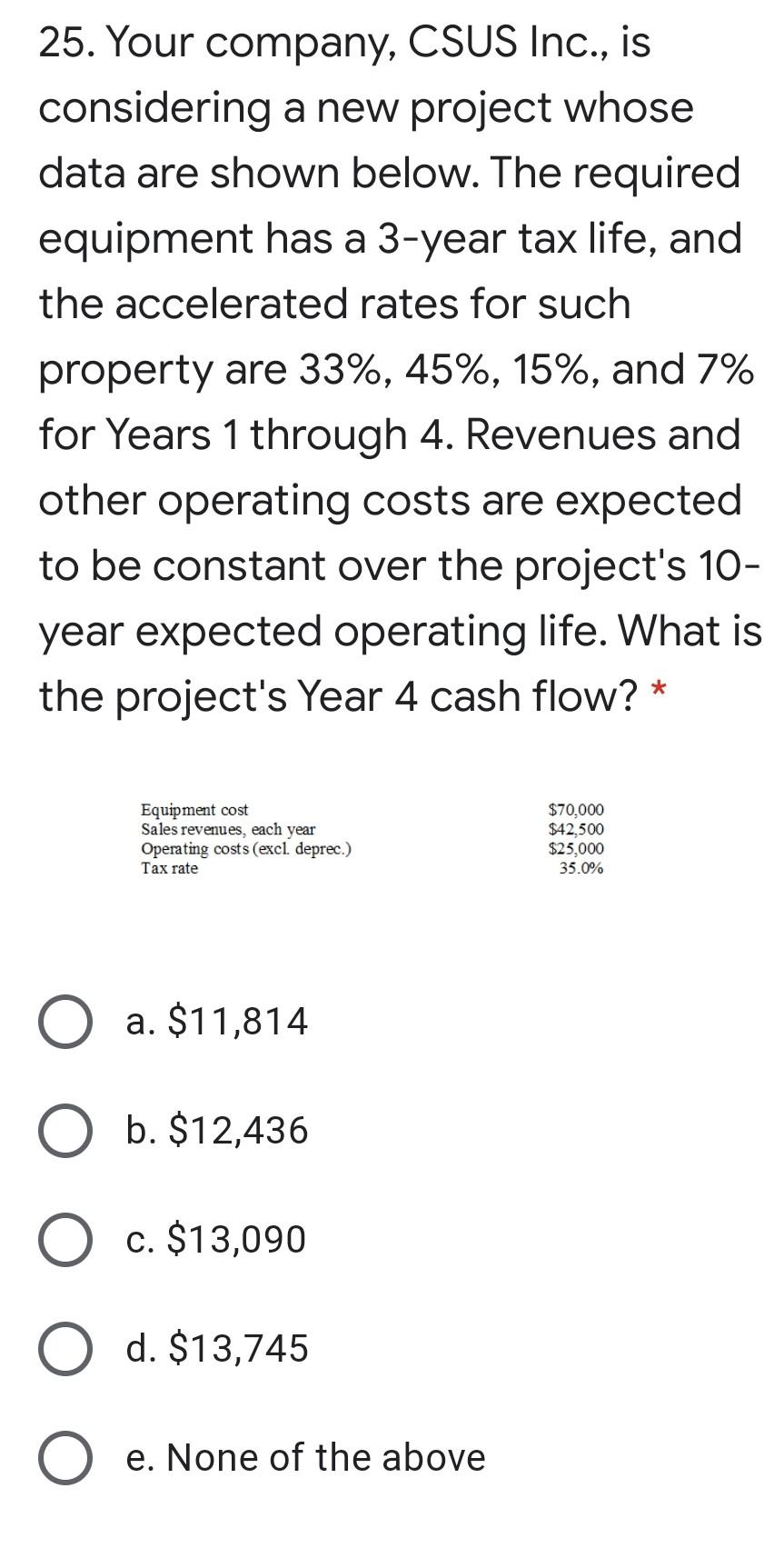

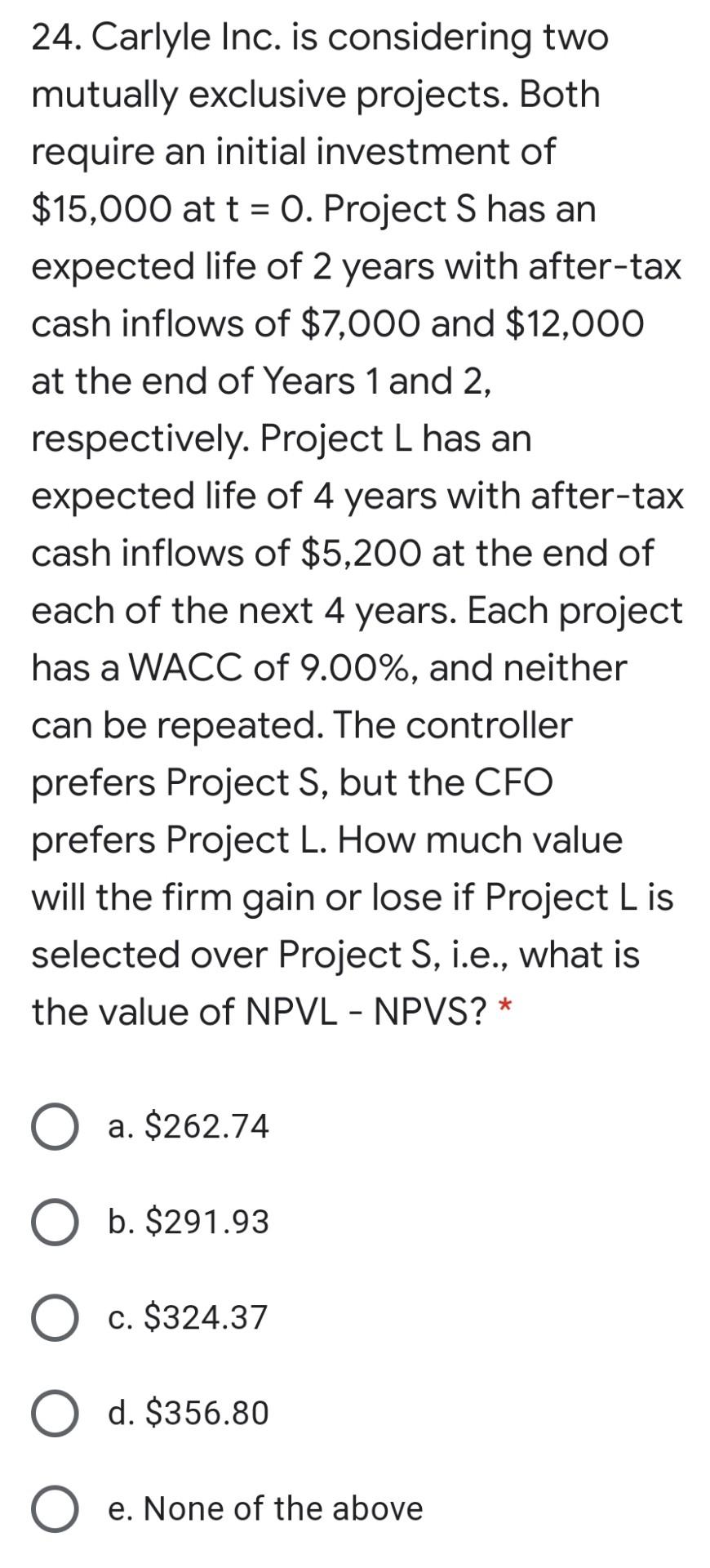

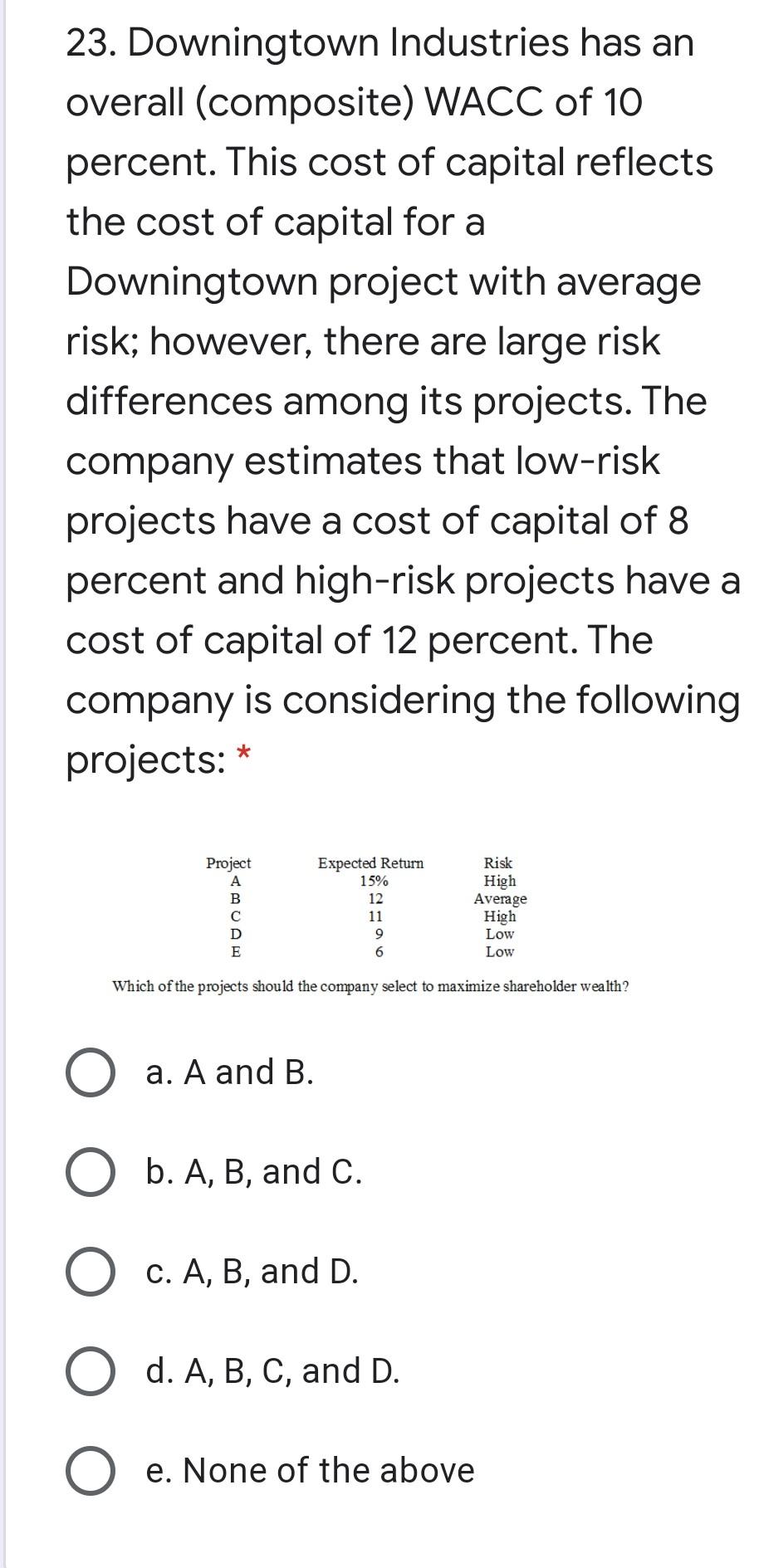

25. Your company, CSUS Inc., is considering a new project whose data are shown below. The required equipment has a 3-year tax life, and the accelerated rates for such property are 33%, 45%, 15%, and 7% for Years 1 through 4. Revenues and other operating costs are expected to be constant over the project's 10- year expected operating life. What is the project's Year 4 cash flow? * Equipment cost Sales revenues, each year Operating costs (excl. deprec.) Tax rate $70,000 $42,500 $25,000 35.0% O a. $11,814 O b. $12,436 c. $13,090 d. $13,745 e. None of the above 24. Carlyle Inc. is considering two mutually exclusive projects. Both require an initial investment of $15,000 at t = 0. Project S has an expected life of 2 years with after-tax cash inflows of $7,000 and $12,000 at the end of Years 1 and 2, respectively. Project L has an expected life of 4 years with after-tax cash inflows of $5,200 at the end of each of the next 4 years. Each project has a WACC of 9.00%, and neither can be repeated. The controller prefers Project S, but the CFO prefers Project L. How much value will the firm gain or lose if Project L is selected over Project S, i.e., what is the value of NPVL - NPVS? * a. $262.74 b. $291.93 c. $324.37 d. $356.80 e. None of the above 23. Downingtown Industries has an overall (composite) WACC of 10 percent. This cost of capital reflects the cost of capital for a Downingtown project with average risk; however, there are large risk differences among its projects. The company estimates that low-risk projects have a cost of capital of 8 percent and high-risk projects have a cost of capital of 12 percent. The company is considering the following projects: * Project A B D E Expected Return 15% 12 11 9 6 Risk High Average High Low Low Which of the projects should the company select to maximize shareholder wealth? a. A and B. b. A, B, and C. C. A, B, and D. d. A, B, C, and D. O e. None of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts