Question: 30. Chapter MC, Section 8, Problem 146 ? Assume That You Are The Portfolio Manager Of The SF Fund, A $3 Million Hedge Fund That

30. Chapter MC, Section 8, Problem 146 ? Assume That You Are The Portfolio Manager Of The SF Fund, A $3 Million Hedge Fund That Contains The Following Stocks. The Required Rate Of Return On The Market Is 11.00% And The Risk-Free Rate Is 2.00%. What Rate Of Return Should Investors Expect And Require) On This Fund? Do Not Round Your Intermediate Calculations.

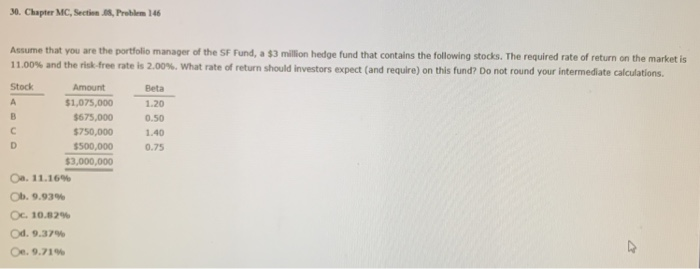

30. Chapter MC, Section .08, Problem 146 Assume that you are the portfolio manager of the SF Fund, a $3 million hedge fund that contains the following stocks. The required rate of return on the market is 11.00% and the risk-free rate is 2.00 %. What rate of return should investors expect (and require) on this fund? Do not round your intermediate calculations. Stock Amount Beta A $1,075,000 1.20 B $675,000 0.50 C $750,000 1.40 D $500,000 0.75 $3,000,000 Oa. 11.16% Ob. 9.93% Oc. 10.82% Od. 9.37% Oe. 9.71%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts