Question: 300,000 is wrong. i need the right answer. and show the process please. Use the following information for the next 8 questions. UCD (U.S. based

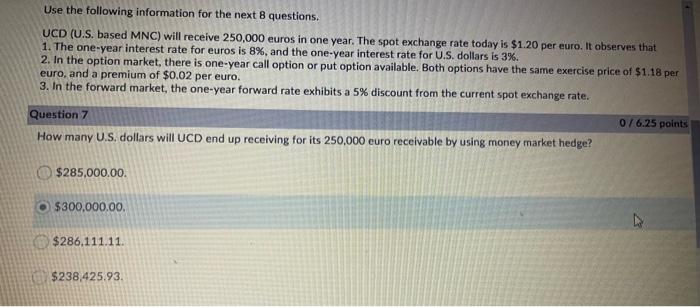

Use the following information for the next 8 questions. UCD (U.S. based MNC) will receive 250,000 euros in one year. The spot exchange rate today is $1.20 per euro. It observes that 1. The one-year interest rate for euros is 8%, and the one-year interest rate for U.S. dollars is 3%. 2. In the option market, there is one-year call option or put option available. Both options have the same exercise price of $1.18 per euro, and a premium of $0.02 per euro. 3. In the forward market, the one-year forward rate exhibits a 5% discount from the current spot exchange rate. Question 7 0/6.25 points How many U.S. dollars will UCD end up receiving for its 250,000 euro receivable by using money market hedge? $285,000.00 $300,000.00 $286.111.11 $238.425.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts