Question: show steps please Imported from Edge G Google Dashboard | Khan A. on=0 Ecourses Y Forex Market For Homepage - Texas http://intranet View Feedback Question

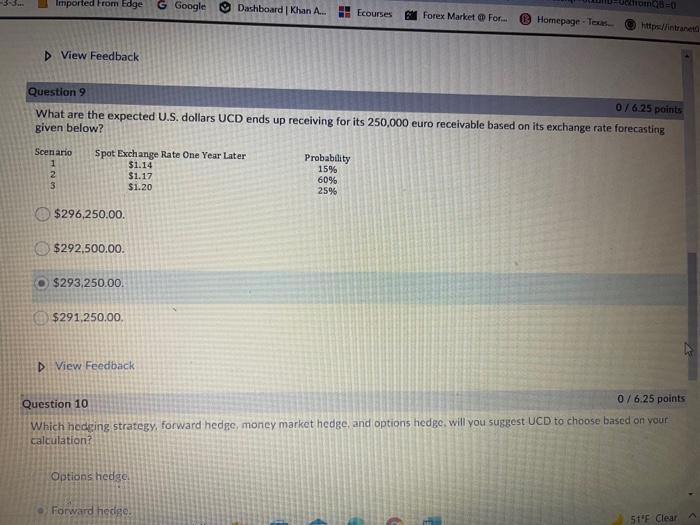

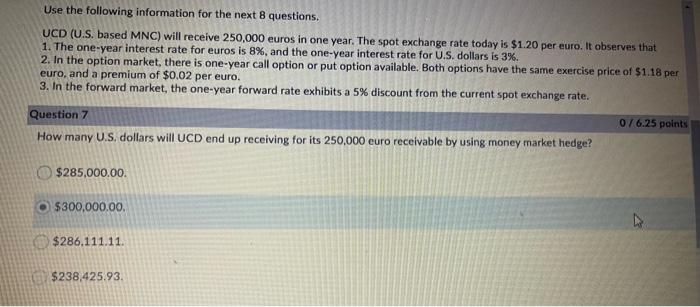

Imported from Edge G Google Dashboard | Khan A. on=0 Ecourses Y Forex Market For Homepage - Texas http://intranet View Feedback Question 9 076.25 points What are the expected U.S. dollars UCD ends up receiving for its 250,000 euro receivable based on its exchange rate forecasting given below? Scenario Spot Exchange Rate One Year Later Probability $1.14 15% 2 $1.17 60% 3 $1.20 25% $296,250.00 $292,500.00 O $293,250.00 $291,250.00 D View Feedback Question 10 0/6.25 points Which hedging strategy forward hedge, money market hedge, and options hedge will you suggest UCD to choose based on your calculation? Options hedge Forward hedge 51F Clear Use the following information for the next 8 questions, UCD (U.S. based MNC) will receive 250,000 euros in one year. The spot exchange rate today is $1.20 per euro. It observes that 1. The one-year interest rate for euros is 8%, and the one-year interest rate for U.S. dollars is 3%. 2. In the option market, there is one-year call option or put option available. Both options have the same exercise price of $1.18 per euro, and a premium of $0.02 per euro. 3. In the forward market, the one-year forward rate exhibits a 5% discount from the current spot exchange rate. Question 7 076.25 points How many U.S. dollars will UCD end up receiving for its 250,000 euro receivable by using money market hedge? $285,000.00 $300,000.00 $286.111.11 $238,425.93

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts