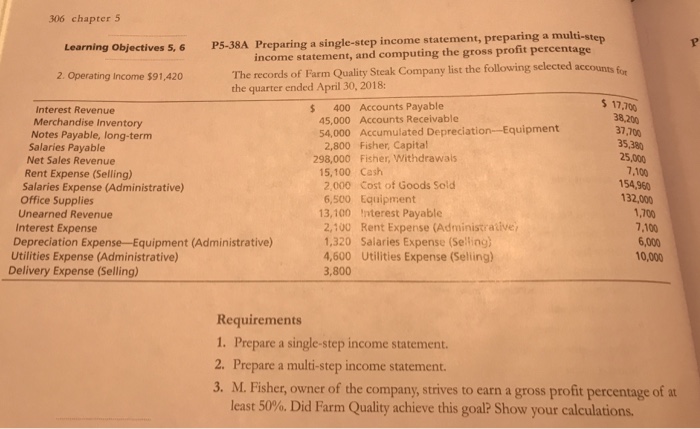

Question: 306 chapter 5 objectives s, 6 P5-38A Preparing a single-step income statement, preparing a multi-step The records of Farm Quality Steak Company list the following

306 chapter 5 objectives s, 6 P5-38A Preparing a single-step income statement, preparing a multi-step The records of Farm Quality Steak Company list the following selected accounts the quarter ended April 30, 2018: income statement, and computing the gross profit percentage 2. Operating Income $91,420 $ 17,700 s 400 Accounts Payable 38,200 45,000 Accounts Receivable 54,000 Accumulated Depreciation-Equipment Interest Revenue 37,700 35,380 25,000 Merchandise Inventory Notes Payable, long-term 2,800 Fisher, Capital Salaries Payable Net Sales Revenue Rent Expense (Selling) Salaries Expense (Administrative) Office Supplies Unearned Revenue 298,000 Fisher, Withdrawals ,100 15,100 Cash 2.000 Cost of Goods Sold 6,500 Equipment 13,100 Interest Payable 2,100 Rent Expense (Administrative 1,320 Salaries Expense (Selling) 4,600 Utilities Expense (Selling) 3,800 154,960 132,000 1,700 7,100 6,000 Interest Expense Depreciation Expense-Equipment (Administrative) Utilities Expense (Administrative) Delivery Expense (Selling) 10,000 Requirements 1. Prepare a single-step income statement. 2. Prepare a multi-step income statement. 3. M. Fisher, owner of the company, strives to earn a gross profit percentage of at least 50%. Did Farm Quality achieve this goal? Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts