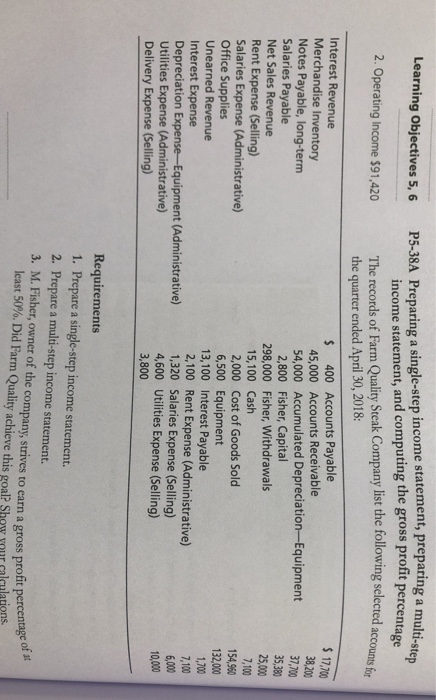

Question: ves 5, 6 P5-38A Preparing a single-step income statement, preparing a multi income statement, and computing the gross profit percenta Learning Objectives 5, 6 P5-38A

ves 5, 6 P5-38A Preparing a single-step income statement, preparing a multi income statement, and computing the gross profit percenta Learning Objectives 5, 6 P5-38A Preparing a single-st ge 2. Operating Income $91,420 The records of Farm Quality Steak Company list the following selected accounts fr the quarter ended April 30, 2018 S 400 Accounts Payable 17,00 Interest Revenue Merchandise Inventory Notes Payable, long-term Salaries Payable Net Sales Revenue Rent Expense (Selling) Salaries Expense (Administrative Office Supplies Unearned Revenue Interest Expense Depreciation E 45,000 Accounts Receivable 54,000 Accumulated Depreciation-Equipment 37,700 5,380 25,000 7,100 154,960 32,000 2,800 Fisher, Capital 298,000 Fisher, Withdrawals 15,100 Cash 2,000 Cost of Goods Sold 6,500 Equipment 13,100 Interest Payable xpense-Equipment (Administrative) nse (Administrative 2,100 Rent Expense (Administrative) 1,320 Salaries Expense (Selling) 4,600 Utilities Expense (Selling) 3,800 7,100 6,000 10,000 Delivery Expense (Selling) Requirements 1. Prepare a single-step income statement. 2. Prepare a multi-step income statement. 3. M. Fisher, owner of the company, strives to earn a gross profit percentage least 50%. Did Farm Quality achieve this goal? Show your calculations

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts