Question: 31. ABC is expected to pay a dividend per share of $2.20 next year. Dividends are expected to grow by 5% forever. What is the

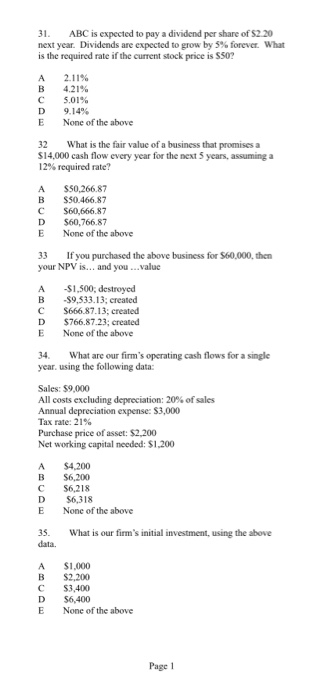

31. ABC is expected to pay a dividend per share of $2.20 next year. Dividends are expected to grow by 5% forever. What is the required rate if the current stock price is S50? A B C D E 2 .11% 4.21% 5,01% 9.14% None of the above 32 What is the fair value of a business that promises a $14,000 cash flow every year for the next 5 years, assuming a 12% required rate? A SS0.266.87 S50 466.87 $60.666.87 $60,766.87 None of the above E 33 If you purchased the above business for $60,000, then your NPV is... and you ...value A B C $1,500, destroyed $9,533.13, created S666.87.13: created $766.87.23, created None of the above D E 34. What are our firm's operating cash flows for a single year, using the following data: Sales: $9,000 All costs excluding depreciation: 20% of sales Annual depreciation expense: $3,000 Tax rate: 21% Purchase price of asset: $2,200 Networking capital needed: $1.200 B C $4.200 $6.200 S6,218 $6,318 None of the above D E 35. data. What is our firm's initial investment, using the above A B C $1.000 $2,200 $3,400 S6,400 None of the above D E Page 1

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts