Question: 31.. I need the solution, the full, correct solution!I will give a thumbs up! A young graduate is trying to decide whether to lease or

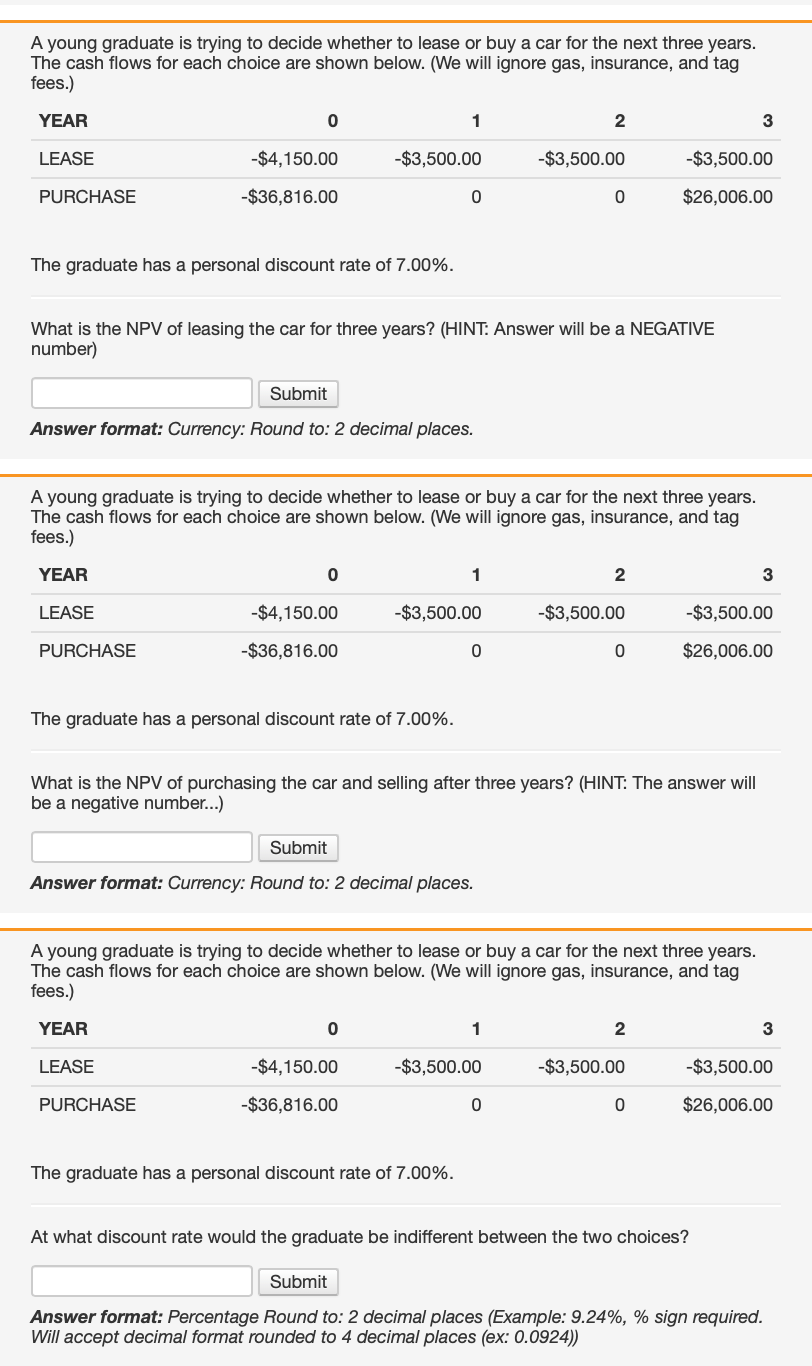

31.. I need the solution, the full, correct solution!I will give a thumbs up!  A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of leasing the car for three years? (HINT: Answer will be a NEGATIVE number) Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of purchasing the car and selling after three years? (HINT: The answer will be a negative number...) Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. At what discount rate would the graduate be indifferent between the two choices? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of leasing the car for three years? (HINT: Answer will be a NEGATIVE number) Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. What is the NPV of purchasing the car and selling after three years? (HINT: The answer will be a negative number...) Answer format: Currency: Round to: 2 decimal places. A young graduate is trying to decide whether to lease or buy a car for the next three years. The cash flows for each choice are shown below. (We will ignore gas, insurance, and tag fees.) The graduate has a personal discount rate of 7.00%. At what discount rate would the graduate be indifferent between the two choices? Answer format: Percentage Round to: 2 decimal places (Example: 9.24\%, \% sign required. Will accept decimal format rounded to 4 decimal places (ex: 0.0924))

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts