Question: 31. In our lecture notes, we learned how to derive Spot Rates using the method of Bootstrapping -- starting with 1- year T-bill (with no

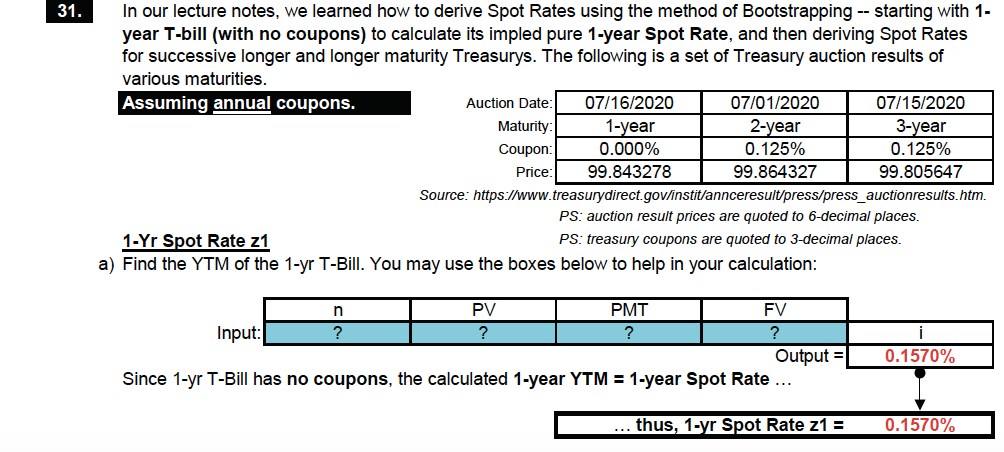

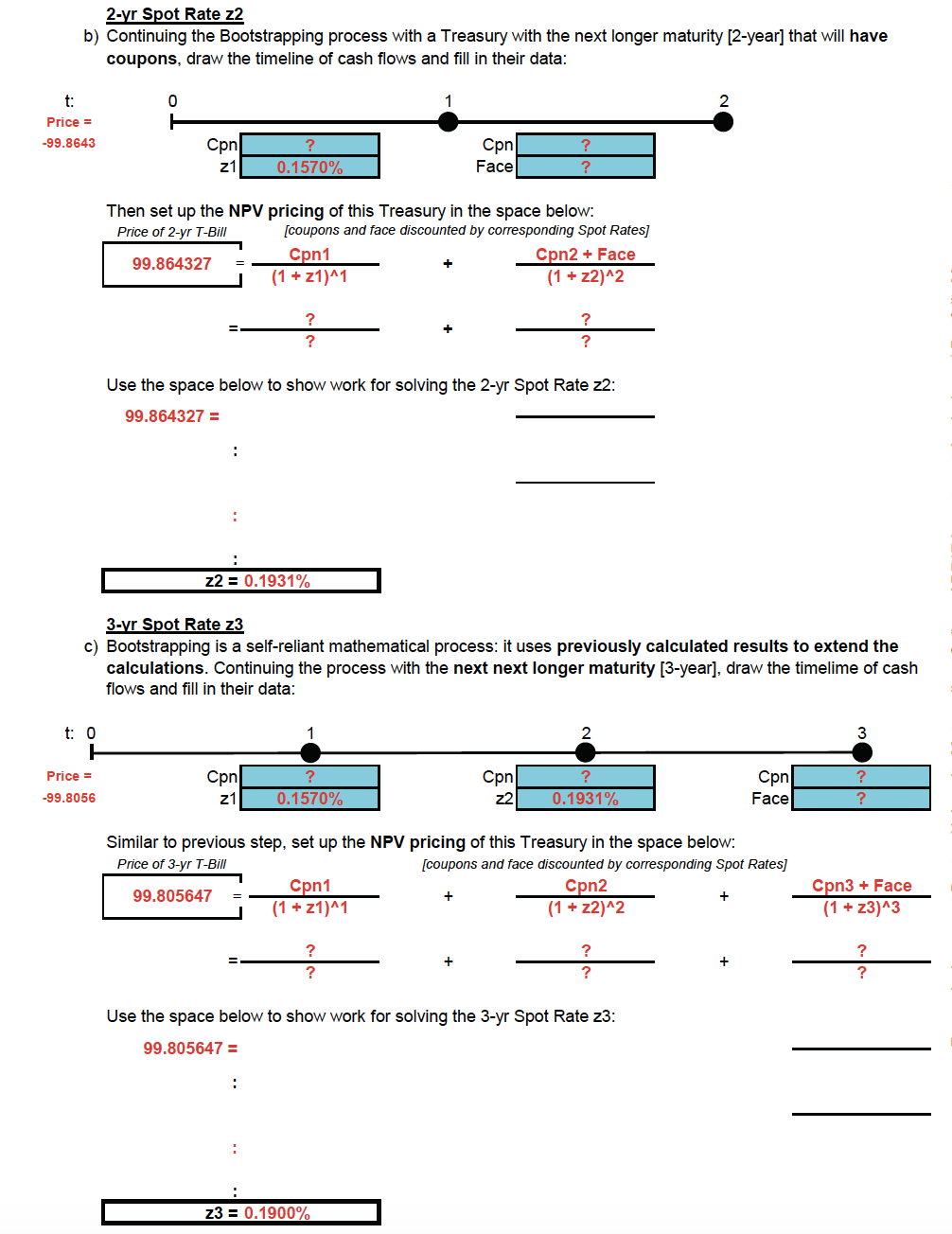

31. In our lecture notes, we learned how to derive Spot Rates using the method of Bootstrapping -- starting with 1- year T-bill (with no coupons) to calculate its impled pure 1-year Spot Rate, and then deriving Spot Rates for successive longer and longer maturity Treasurys. The following is a set of Treasury auction results of various maturities. Assuming annual coupons. Auction Date: 07/16/2020 07/01/2020 07/15/2020 Maturity: 1-year 2-year 3-year Coupon: 0.000% 0.125% 0.125% Price 99.843278 99.864327 99.805647 Source: https://www.treasurydirect.gov/instit/annceresult/press/press_auctionresults.htm. PS: auction result prices are quoted to 6-decimal places. 1-Yr Spot Rate z1 PS: treasury coupons are quoted to 3-decimal places. a) Find the YTM of the 1-yr T-Bill. You may use the boxes below to help in your calculation: n PV PMT FV Input: 1 ? ? ? ? Output = Since 1-yr T-Bill has no coupons, the calculated 1-year YTM = 1-year Spot Rate ... 0.1570% ... thus, 1-yr Spot Rate z1 = 0.1570% 2-yr Spot Rate z2 b) Continuing the Bootstrapping process with a Treasury with the next longer maturity [2-year] that will have coupons, draw the timeline of cash flows and fill in their data: t: 0 2 Price = -99.8643 ? Cpn ? Cpn 21 0.1570% Face Then set up the NPV pricing of this Treasury in the space below: Price of 2-yr T-Bill [coupons and face discounted by corresponding Spot Rates] Cpn1 99.864327 Cpn2 + Face (1 + z1)^1 (1 + z2)^2 ? ? ? ? Use the space below to show work for solving the 2-yr Spot Rate 22: 99.864327 = z2 = 0.1931% 3-vr Spot Rate 23 c) Bootstrapping is a self-reliant mathematical process: it uses previously calculated results to extend the calculations. Continuing the process with the next next longer maturity (3-year], draw the timelime of cash flows and fill in their data: t: 0 3 Price = ? Cpn 21 Cpn 22 ? 0.1931% Cpn Face -99.8056 0.1570% ? Similar to previous step, set up the NPV pricing of this Treasury in the space below: Price of 3-yr T-Bill [coupons and face discounted by corresponding Spot Rates] 99.805647 Cpn1 Cpn2 (1 + 21)^1 (1 + z2)^2 Cpn3 + Face (1 + z3)^3 ? ? ? ? ? ? Use the space below to show work for solving the 3-yr Spot Rate 23: 99.805647 = z3 = 0.1900%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts