Question: 31. The most appropriate discount rate to use when applying the Operating Free Cash Flows model is the firm's a. Required rate of retum based

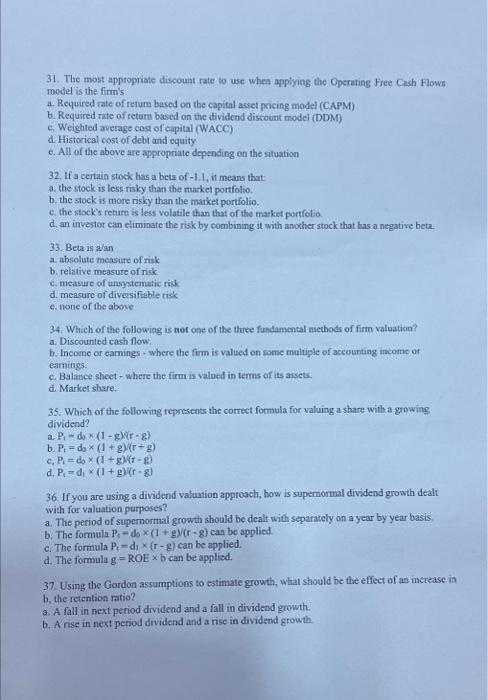

31. The most appropriate discount rate to use when applying the Operating Free Cash Flows model is the firm's a. Required rate of retum based on the capital asset pricing model (CAPM) b. Required rate of retum based on the dividend discount model (DDM) c. Weighted average cos of capital (WACC) d. Historical cost of debt and equity e. All of the above are appropriate depending on the situation 32. If a certain stock has a beta of 1.1, it means that: a. the stock is less risky than the market portfolo. b. the sock is more risky than the market portfolio. c. the stock's return is less volatile than that of the market porffolo. d. an investor can eliminate the risk by combining it with another stock that bis a negative beta. 33. Beta is alan a. absolute measure of risk b. relative measure of risk c. measure of unsystematic risk d. measure of diversifiable risk e. none of the above 34. Which of the following is not one of the three fundamental mechods of firm valuation? a. Discounted cash flow. b. Income or earnings - where the firm is valued on some maluple of accounting incorne of earnings. c. Balasce sheet - where the firm is valued in terms of its assets. d. Market share. 35. Which of the following represents the correct fomula for valuing a share with a growing dividend? a. Pt=d0(1g)(rg) b. Pt=db(1+g)(r+g) c. Pt=d0(1+g)(rg) d. Pc=d1(1+g)(rg) 36. If you are using a dividend valuation approach, how is supernormal dividend growth dealt with for valuation purposes? a. The period of supernormal growth should be dealt with separately on a year by year basis. b. The formula P1=db(1+g)(rg) can be applied. c. The formula Pt=d1(rg) can be applied. d. The formula g=ROEb can be applied. 37. Using the Gardon assumptions to estimate growth, what should be the effect of an increase in b, the retention ratio? a. A fall in next period dividend and a fall in dividend growth. b. A rise in next period dividend and a rise in dividend growth

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts