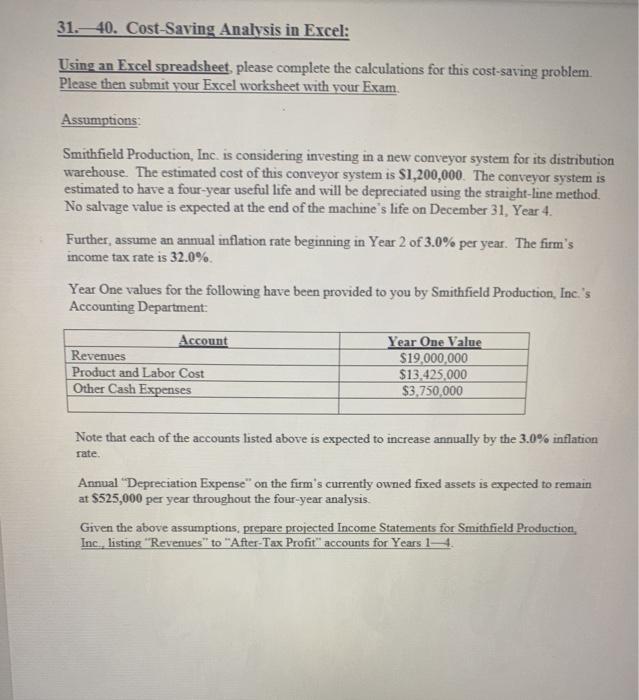

Question: 31.40. Cost-Saving Analysis in Excel: Using an Excel spreadsheet, please complete the calculations for this cost-saving problem Please then submit your Excel worksheet with your

31.40. Cost-Saving Analysis in Excel: Using an Excel spreadsheet, please complete the calculations for this cost-saving problem Please then submit your Excel worksheet with your Exam. Assumptions: Smithfield Production, Inc. is considering investing in a new conveyor system for its distribution warehouse. The estimated cost of this conveyor system is $1,200,000. The conveyor system is estimated to have a four-year useful life and will be depreciated using the straight-line method. No salvage value is expected at the end of the machine's life on December 31, Year 4. Further, assume an annual inflation rate beginning in Year 2 of 3.0% per year. The firm's income tax rate is 32.0%. Year One values for the following have been provided to you by Smithfield Production, Inc.'s Accounting Department: Account Revenues Product and Labor Cost Other Cash Expenses Year One Value $19,000,000 $13.425,000 $3,750,000 Note that each of the accounts listed above is expected to increase annually by the 3.0% inflation rate. Annual "Depreciation Expense" on the firm's currently owned fixed assets is expected to remain at S525,000 per year throughout the four-year analysis. Given the above assumptions, prepare projected Income Statements for Smithfield Production, Inc, listing "Revenues" to "After-Tax Profit" accounts for Years 14

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts