Question: 32. Mr. Moore is thinking about how much the return of Apple stock could be given it's beta of 1.11 for a possible investment he

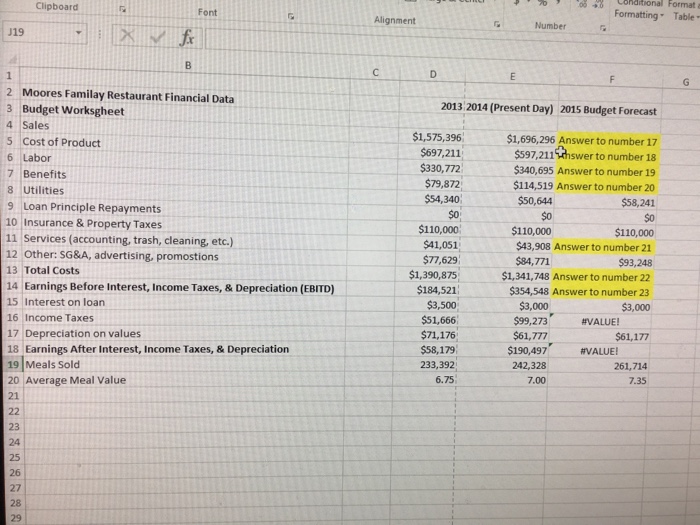

Clipboard a Conaitional Format a - Font Alignment Formatting Table Number J19 2 Moores Familay Restaurant Financial Data 3 Budget Worksgheet 4 Sales 5 Cost of Product 6 Labor 7 Benefits 8 Utilities 9 Loan Principle Repayments 10 Insurance & Property Taxes 11 Services (accounting, trash, cleaning, etc.) 12 Other: SG&A, advertising, promostions 13 Total Costs 14 Earnings Before Interest, Income Taxes, & Depreciation (EBITD 15 Interest on loan 16 Income Taxes 17 Depreciation on values 18 Earnings After Interest, Income Taxes, & Depreciation 19 Meals Sold 20 Average Meal Value 21 2013 2014 (Present Day) 2015 Budget Forecast $1,575,396 $697,211 $330,772 $79,872 $54,340 $1,696,296 Answer to number 17 $597,211 thswer to number 18 340,695 Answer to number 19 $114,519 Answer to number 20 $58,241 $50,644 $110,000 $84,771 so, $110,000 $41,051 77,629 $110,000 $43,908 Answer to number 21 $93,248 $1,341, 748 Answer to number 22 $354,548 Answer to number 23 $3,000 $1,390,875 $184,521 $3,500 51,666 $71,176 $58,179 233,392 6.75 $3,000 $99,273 $61,777 $190,497 242,328 7.00 EVALUE! $61,177 VALUE! 261,714 7.35 23 25 27 28

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts