Question: 32. Why might passive portfolio Management be better than active? a. Passive management results in lower transactions costs b. Active management charges lower management fees

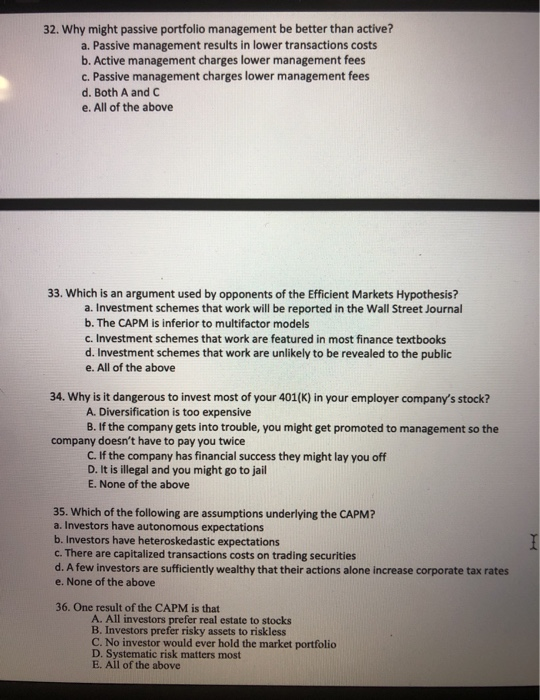

32. Why might passive portfolio Management be better than active? a. Passive management results in lower transactions costs b. Active management charges lower management fees C. Passive management charges lower management fees d. Both A and C e. All of the above 33. Which is an argument used by opponents of the Efficient Markets Hypothesis? a. Investment schemes that work will be reported in the Wall Street Journal b. The CAPM is inferior to multifactor models c. Investment schemes that work are featured in most finance textbooks d. Investment schemes that work are unlikely to be revealed to the public e. All of the above 34. Why is it dangerous to invest most of your 401(K) in your employer company's stock? A. Diversification is too expensive B. If the company gets into trouble, you might get promoted to management so the company doesn't have to pay you twice C. If the company has financial success they might lay you off D. It is illegal and you might go to jail E. None of the above 35. Which of the following are assumptions underlying the CAPM? a. Investors have autonomous expectations b. Investors have heteroskedastic expectations c. There are capitalized transactions costs on trading securities d. A few investors are sufficiently wealthy that their actions alone increase corporate tax rates e. None of the above 36. One result of the CAPM is that A. All investors prefer real estate to stocks B. Investors prefer risky assets to riskless C. No investor would ever hold the market portfolio D. Systematic risk matters most E. All of the above

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts