Question: 33) The Fidelity Magellan Fund has a return (expected return) of 20% and a standard deviation of 25%. The T. Rowe Price Blue Chip Growth

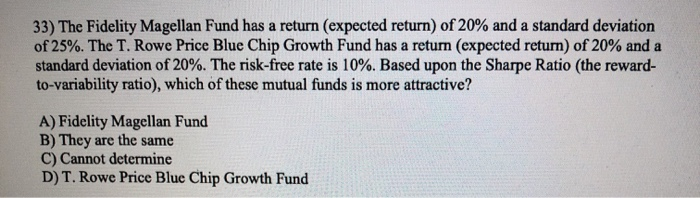

33) The Fidelity Magellan Fund has a return (expected return) of 20% and a standard deviation of 25%. The T. Rowe Price Blue Chip Growth Fund has a return (expected return) of 20% and a standard deviation of 20%. The risk-free rate is 10%. Based upon the Sharpe Ratio (the reward- to-variability ratio), which of these mutual funds is more attractive? A) Fidelity Magellan Fund B) They are the same C) Cannot determine D) T. Rowe Price Blue Chip Growth Fund

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts