Question: please help Problem Description Consider data on earnings for companies listed on the S&P500 stock index. NE gives nominal earnings (i.e. earnings that are not

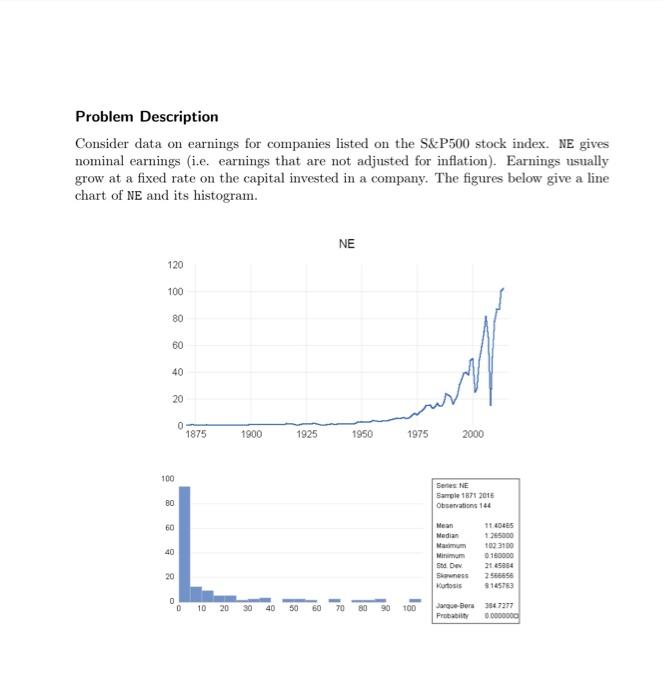

Problem Description Consider data on earnings for companies listed on the S\&P500 stock index. NE gives nominal earnings (i.e. earnings that are not adjusted for inflation). Earnings usually grow at a fixed rate on the capital invested in a company. The figures below give a line chart of NE and its histogram. Questions: (a) Discuss the distribution of NE. What are the estimates for central tendency of the distribution (give all that are mentioned). Is its distribution skewed or symmetric, and if so, in which direction is NE skewed? Explain. (b) In your answer in (a), what do you think is the reason behind the observed skewness (or symmetry)? (c) An analyst observes that the (Pearson's) correlation coefficient of NE with dividends is 0.85 . What does this mean for the relationship between the two variables? Give an interpretation for it. (d) The analyst claims that the correlation indicates that high earnings cause high dividends. Is she (or he) right? Discuss

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts