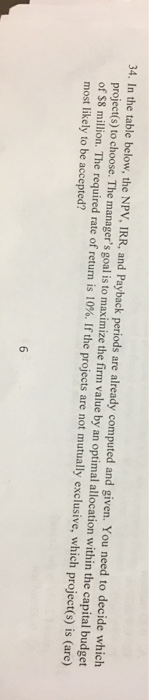

Question: 34. In the table below, the NPV, IRR, and Payback periods are already computed and given. You need to decide which project(s) to choose. The

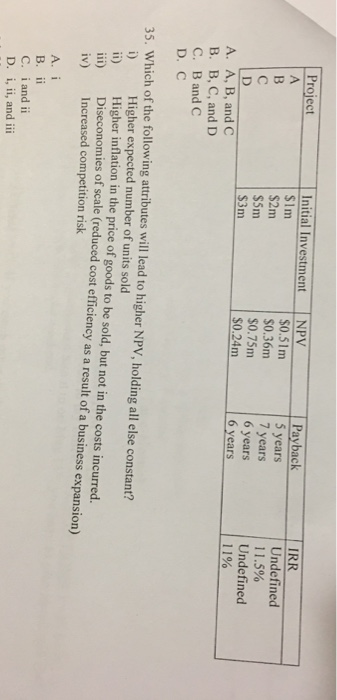

34. In the table below, the NPV, IRR, and Payback periods are already computed and given. You need to decide which project(s) to choose. The manager's goal is to maximize the firm value by an optimal allocation within the capital budget of S8 million. The required rate of return is 10%. If the projec most likely to be accepted? ts are not mutually exclusive, which project s is (are) Payback 5 years 7 years 6 years 6 years IRR Initial Investment NPV Project Undefined 11.5% Undefined 11%, S1m S2m S5m S0.51m S0.36m S0.75m 0.24m A. A, B, and C B. B, C, and D C. B and C D. C 35. Which of the following attributes will lead to higher NPV, holding all else constant? Higher expected number of units sold iHigher inflation in the price of goods to be sold, but not in the costs incurred. nomies of scale (reduced cost efficiency as a result of a business expansion) iii) Diseco iv) Increased competition risk C. i and i D. i, ii, and

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts