Question: 3.4 Selecting the appropriate absorption base Management should try to establish an absorption rate that provides a reasonably accurate' estimate of overhead costs for jobs,

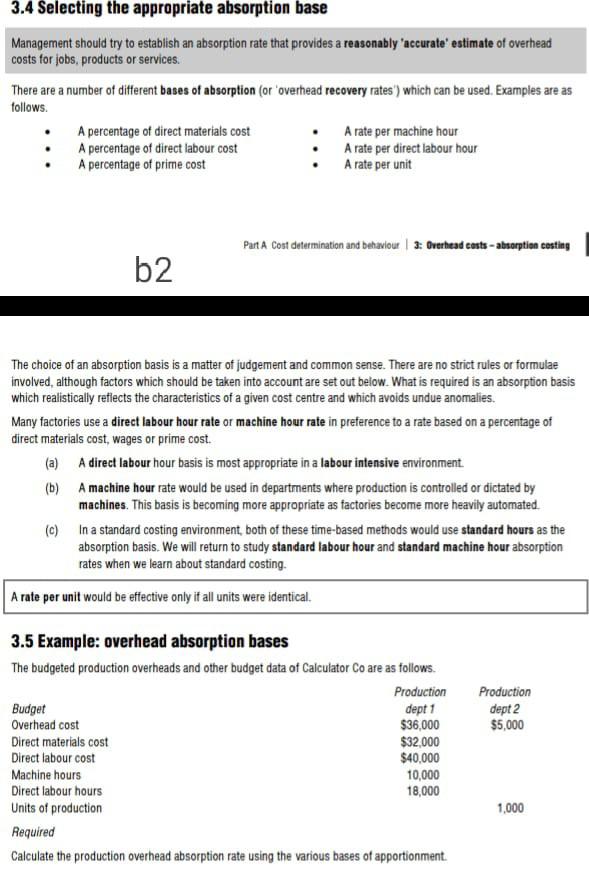

3.4 Selecting the appropriate absorption base Management should try to establish an absorption rate that provides a reasonably accurate' estimate of overhead costs for jobs, products or services. There are a number of different bases of absorption (or 'overhead recovery rates") which can be used. Examples are as follows A percentage of direct materials cost A rate per machine hour A percentage of direct labour cost A rate per direct labour hour A percentage of prime cost A rate per unit Part A Cost determination and behaviour 3: Overhead costs - absorption costing b2 The choice of an absorption basis is a matter of judgement and common sense. There are no strict rules or formulae Involved, although factors which should be taken into account are set out below. What is required is an absorption basis which realistically reflects the characteristics of a given cost centre and which avoids undue anomalies. Many factories use a direct labour hour rate or machine hour rate in preference to a rate based on a percentage of direct materials cost, wages or prime cost. (a) A direct labour hour basis is most appropriate in a labour intensive environment. (b) A machine hour rate would be used in departments where production is controlled or dictated by machines. This basis is becoming more appropriate as factories become more heavily automated (c) in a standard costing environment, both of these time-based methods would use standard hours as the absorption basis. We will return to study standard labour hour and standard machine hour absorption rates when we learn about standard costing. A rate per unit would be effective only if all units were identical. Production dept 2 $5,000 3.5 Example: overhead absorption bases The budgeted production overheads and other budget data of Calculator Co are as follows. Production Budget dept 1 Overhead cost $36,000 Direct materials cost $32,000 Direct labour cost $40,000 Machine hours 10,000 Direct labour hours 18,000 Units of production Required Calculate the production overhead absorption rate using the various bases of apportionment. 1,000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts