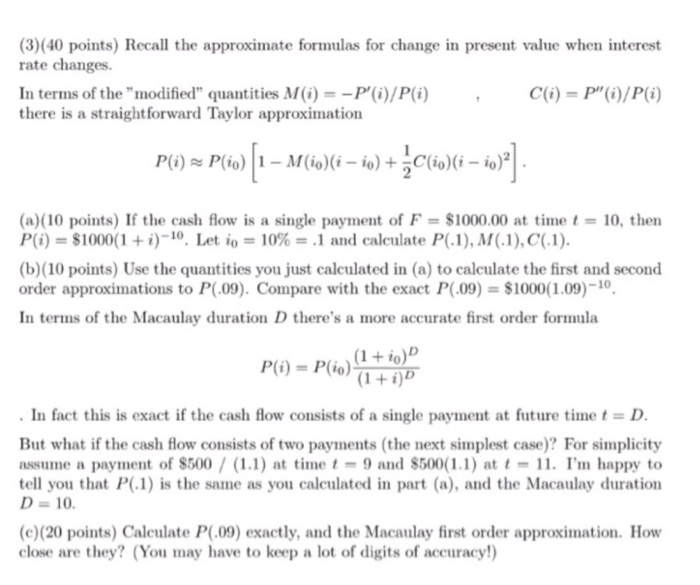

Question: (3)(40 points) Recall the approximate formulas for change in present value when interest rate changes. In terms of the modified quantities M(i)--P()/P(i)C) there is a

(3)(40 points) Recall the approximate formulas for change in present value when interest rate changes. In terms of the "modified" quantities M(i)--P()/P(i)C) there is a straightforward Taylor approximation P")/Pi) (a)(10 points) If the cash flow is a single payment of F = $1000.00 at time t = 10, then P(i) = $1000(1 + i)-10. Let io = 10% = .1 and calculate P(.1),M(.1),CLI). (b)(10 points) Use the quantities you just calculated in (a) to calculate the first and second order approximations to P(.09). Compare with the exact P(.09)-$1000(1.09)-10 In terms of the Macaulay duration D there's a more accurate first order formula P(i) = P(io)atto) (1 +iD (1 +io)D . In fact this is exact if the cash flow consists of a single payment at future time t = D But what if the cash flow consists of two payments (the next simplest case)? For simplicity assume a payment of $500/(1.1) at timet-9 and $500(1.1) . I'm happy to tell you that P(1) is the same as you calculated in part (a), and the Macaulay duration D-10 (e)(20 points) Caleulate P(.09) exactly, and the Macaulay first order approximation. How close are they? (You may have to keep a lot of digits of accuracy

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts