Question: 3:5 missing boxes (Working with financial statements) Based on the balance sheet and income statement for T. P. Jarmon Company for the year ended December

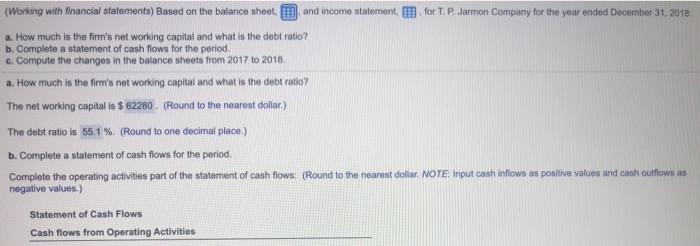

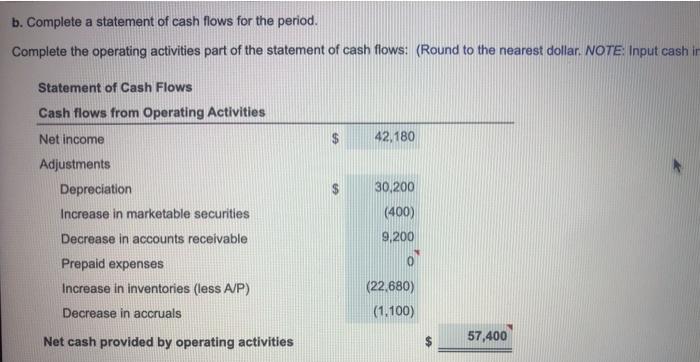

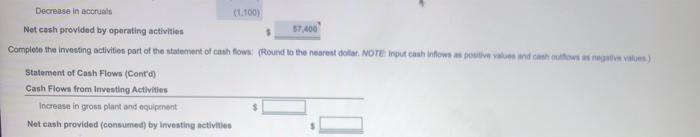

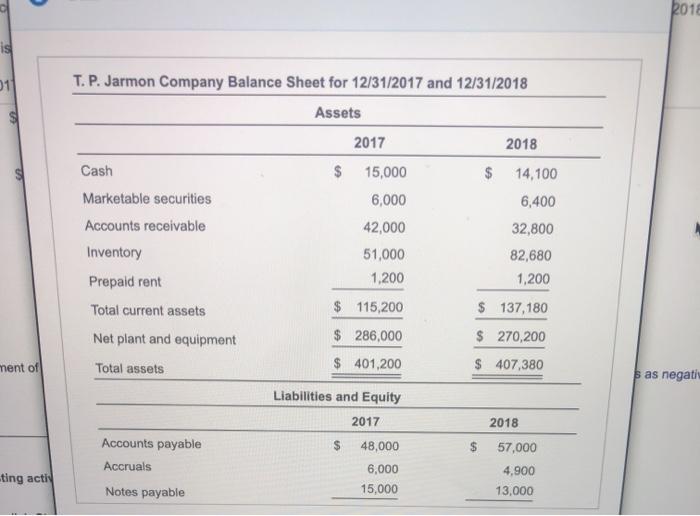

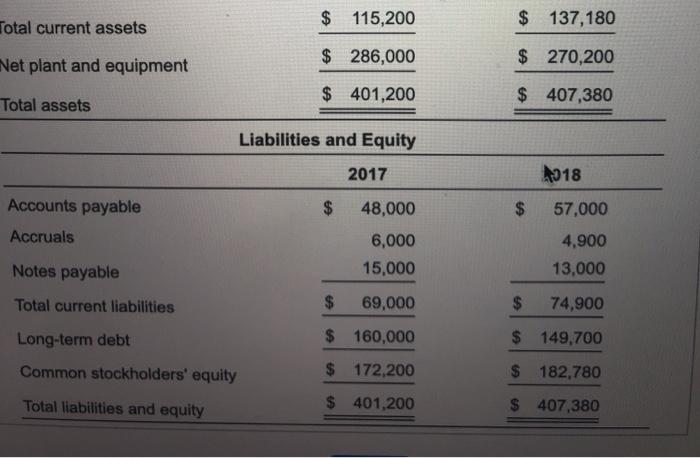

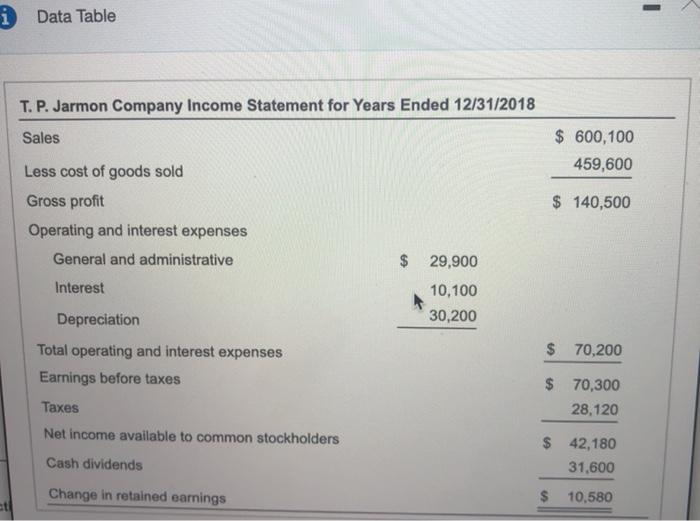

(Working with financial statements) Based on the balance sheet and income statement for T. P. Jarmon Company for the year ended December 31, 2018 a. How much is the firm's net working capital and what is the debt ratio? b. Complete a statement of cash flows for the period c. Compute the changes in the balance sheets from 2017 to 2018 a. How much is the firm's not working capital and what is the debt ratio The net working capital is $ 62280 (Round to the nearest dollar) The debt ratio in 651 % (Round to one decimal place.) b. Complete a statement of cash flows for the period. Complete the operating activities part of the statement of cash flows: (Round to the nearest dollar. NOTE Input cash inflows as positive values and cash outlows an negative values.) Statement of Cash Flows Cash flows from Operating Activities b. Complete a statement of cash flows for the period. Complete the operating activities part of the statement of cash flows: (Round to the nearest dollar. NOTE: Input cash in Statement of Cash Flows Cash flows from Operating Activities Net income 42,180 Adjustments Depreciation Increase in marketable securities Decrease in accounts receivable Prepaid expenses Increase in inventories (less A/P) Decrease in accruals 30,200 (400) 9.200 (22,680) (1.100) Net cash provided by operating activities $ 57,400 Decrease in accruals (1.100) Net cash provided by operating activities 57,400 Complete the investing activition part of the statement of cihah flows: (Round to the nearest dotat. NOTE Tnput tahots positive values and change toes) Statement of Cash Flows (Cont'd) Cash Flows from Investing Activities Increase in gros plant and equipment Net cash provided (consumed) by investing activities 2018 is 1 T. P. Jarmon Company Balance Sheet for 12/31/2017 and 12/31/2018 Assets 2017 2018 Cash $ 14,100 6,400 Marketable securities Accounts receivable Inventory Prepaid rent Total current assets Net plant and equipment Total assets $ 15,000 6,000 42,000 51,000 1,200 $ 115,200 32,800 82,680 1,200 $ 137,180 $ 286,000 $ 270,200 $ 407,380 ment of $ 401,200 s as negati Liabilities and Equity 2017 2018 $ $ Accounts payable Accruals 48,000 6,000 15,000 57,000 4.900 13,000 ting acti Notes payable $ 115,200 $ 137,180 Total current assets $ 286,000 $ 270,200 Net plant and equipment $ 401,200 Total assets $ 407,380 Liabilities and Equity 2017 1918 Accounts payable $ 48,000 $ 57,000 Accruals 6,000 15,000 4,900 13,000 Notes payable Total current liabilities $ 69,000 $ 74,900 Long-term debt $ 160,000 $ 149,700 Common stockholders' equity $ 172,200 $ 182,780 Total liabilities and equity $ 401,200 $ 407,380 i Data Table T. P. Jarmon Company Income Statement for Years Ended 12/31/2018 Sales $ 600,100 459,600 $ 140,500 Less cost of goods sold Gross profit Op ing and interest expenses General and administrative $ 29,900 Interest 10,100 30,200 Depreciation $ 70,200 Total operating and interest expenses Earnings before taxes $ 70,300 28,120 Taxes Net income available to common stockholders Cash dividends $ 42,180 31,600 Change in retained earnings $ 10.580 et

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts