Question: 3:5 (Working with financial statements) Based on the balance sheet, and income statement, for T. P. Jarmon Company for the year ended December 31, 2018:

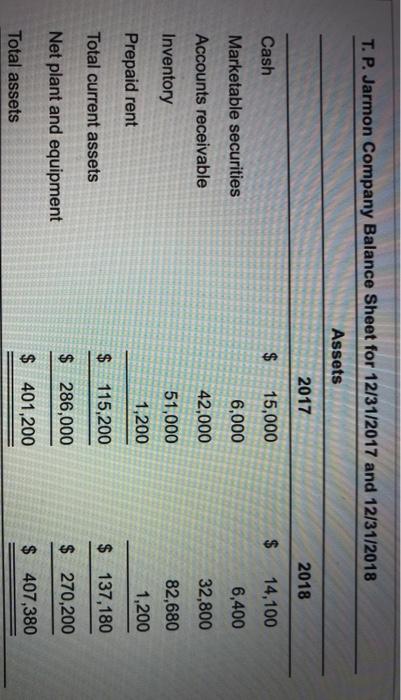

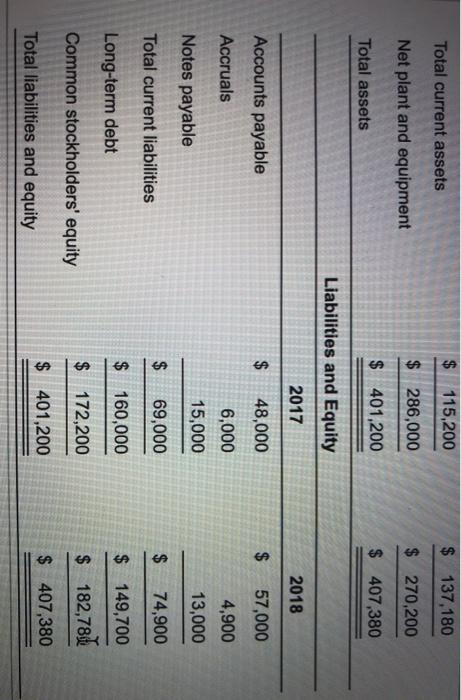

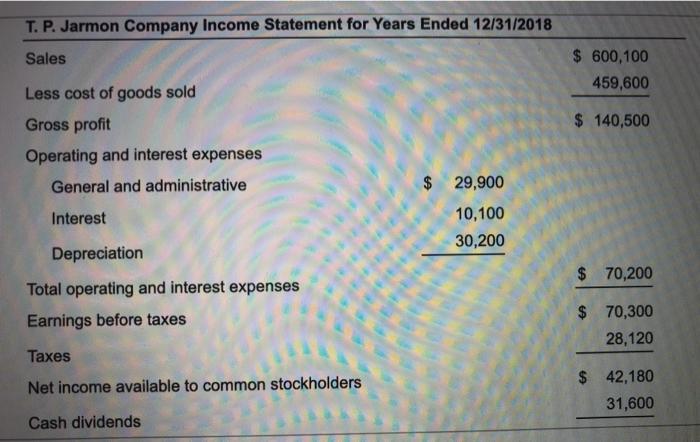

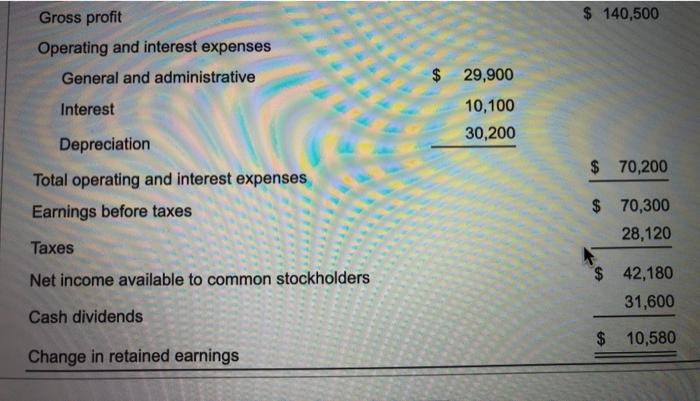

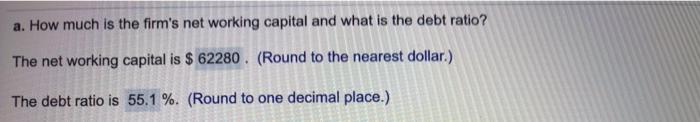

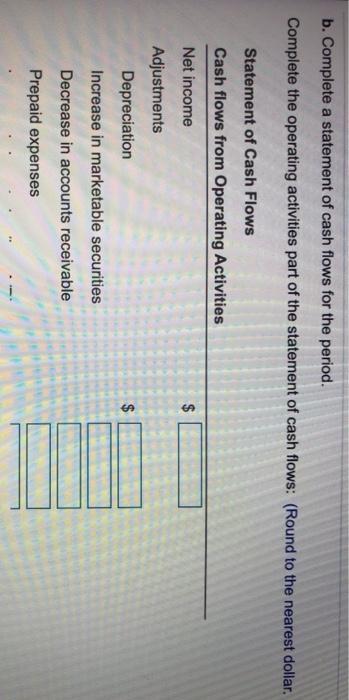

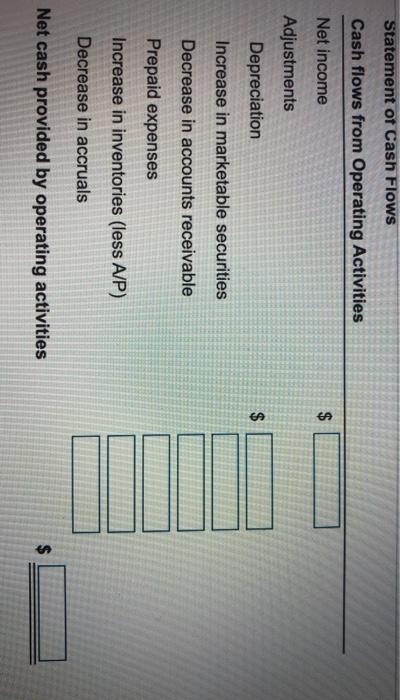

(Working with financial statements) Based on the balance sheet, and income statement, for T. P. Jarmon Company for the year ended December 31, 2018: a. How much is the firm's net working capital and what is the debt ratio? b. Complete a statement of cash flows for the period. c. Compute the changes in the balance sheets from 2017 to 2018. T. P. Jarmon Company Balance Sheet for 12/31/2017 and 12/31/2018 Assets 2017 2018 Cash $ 15,000 $ 14,100 6,400 Marketable securities 6,000 Accounts receivable 42,000 32,800 Inventory 51,000 82,680 1,200 1,200 Prepaid rent $ 137,180 $ 115,200 Total current assets $ 286,000 $ 270,200 Net plant and equipment $ 401,200 $ 407,380 Total assets Total current assets $ 115,200 $ 137,180 Net plant and equipment $ 286,000 $ 270,200 $ 401,200 $ 407,380 Total assets Liabilities and Equity 2017 2018 Accounts payable $ 48,000 $ 57,000 Accruals 4,900 6,000 15,000 Notes payable 13,000 $ Total current liabilities $ 69,000 74,900 $ 160,000 $ 149,700 Long-term debt $ 172,200 Common stockholders' equity $ 182,7844 $ 401,200 $ 407,380 Total liabilities and equity T. P. Jarmon Company Income Statement for Years Ended 12/31/2018 Sales $ 600,100 459,600 $ 140,500 Less cost of goods sold Gross profit Operating and interest expenses General and administrative Interest $ 29,900 10,100 30,200 Depreciation $ 70,200 Total operating and interest expenses Earnings before taxes $ 70,300 28,120 Taxes Net income available to common stockholders $ 42,180 31,600 Cash dividends $ 140,500 Gross profit Operating and interest expenses General and administrative Interest 29,900 10,100 30,200 $ 70,200 Depreciation Total operating and interest expenses Earnings before taxes $ 70,300 28,120 Taxes Net income available to common stockholders $ 42,180 31,600 Cash dividends $ 10,580 Change in retained earnings a. How much is the firm's net working capital and what is the debt ratio? The net working capital is $ 62280. (Round to the nearest dollar.) The debt ratio is 55.1 %. (Round to one decimal place.) b. Complete a statement of cash flows for the period. Complete the operating activities part of the statement of cash flows: (Round to the nearest dollar. Statement of Cash Flows Cash flows from Operating Activities Net income $ Adjustments Depreciation Increase in marketable securities $ Decrease in accounts receivable Prepaid expenses Statement of Cash Flows Cash flows from Operating Activities Net income $ Adjustments Depreciation $ Increase in marketable securities Decrease in accounts receivable Prepaid expenses Increase in inventories (less A/P) Decrease in accruals Net cash provided by operating activities

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts