Question: #36 use the 13 basic ratios Cash Accounts receivable Inventory Total current assets Fixed assets ********* Total assets Current debt Long-term debt Total debt Equity

#36

use the 13 basic ratios

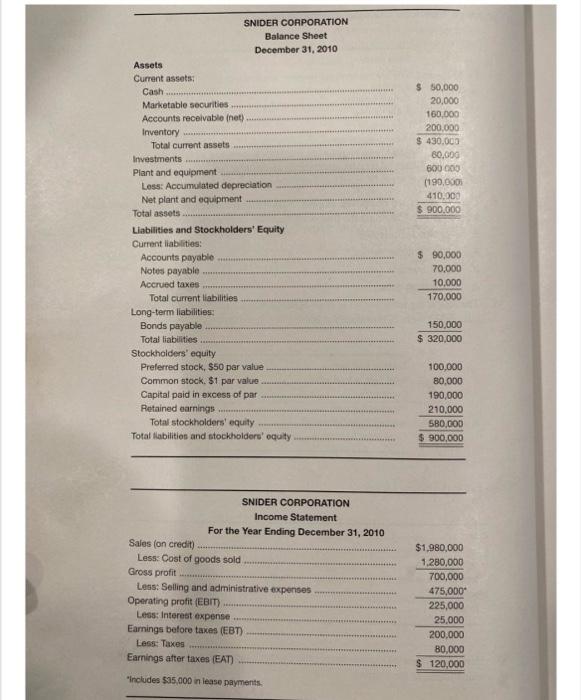

Cash Accounts receivable Inventory Total current assets Fixed assets ********* Total assets Current debt Long-term debt Total debt Equity Total debt and equity 10 36. Using the financial statements for the Snider Corporation, calculate the basic X ratios found in the chapter. Comp ratios 05:51 $ 50,000 20.000 160.000 200,000 $430,000 60,000 600 000 (190,000 410.000 $.900.000 SNIDER CORPORATION Balance Sheet December 31, 2010 Assets Current assets; Cash Marketable securities Accounts receivable (net) Inventory Total current assets Investments Plant and equipment Loss: Accumulated depreciation Net plant and equipment Total assets. Liabilities and Stockholders' Equity Current liabilities: Accounts payable ... Notes payable Accrued taxes Total current liabilities Long-term liabilities: Bonds payable Total liabilities Stockholders' equity Preferred stock, $50 par value Common stock. $1 par value Capital paid in excess of par Retained earnings Total stockholders' equity Total abilities and stockholders' equity $ 90,000 70,000 10,000 170,000 150,000 $ 320,000 100,000 80,000 190,000 210,000 580,000 $ 900,000 SNIDER CORPORATION Income Statement For the Year Ending December 31, 2010 Sales (on credit) Less: Cost of goods sold Gross profit Lens: Selling and administrative expenses Operating profit (EBIT) Less: Interest expense. Earnings before taxes (EBT) Less: Taxes Earnings after taxes (EAT) $1,980,000 1.280,000 700,000 475,000 225,000 25,000 200,000 80,000 $ 120,000 "Includes $35.000 in lease payments

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts