Question: 370 Chapter 9 Financing a Business 2 Raising Long- Term Fends ning Inc. (EC) is considering issuing new shares and wants to maximize the t

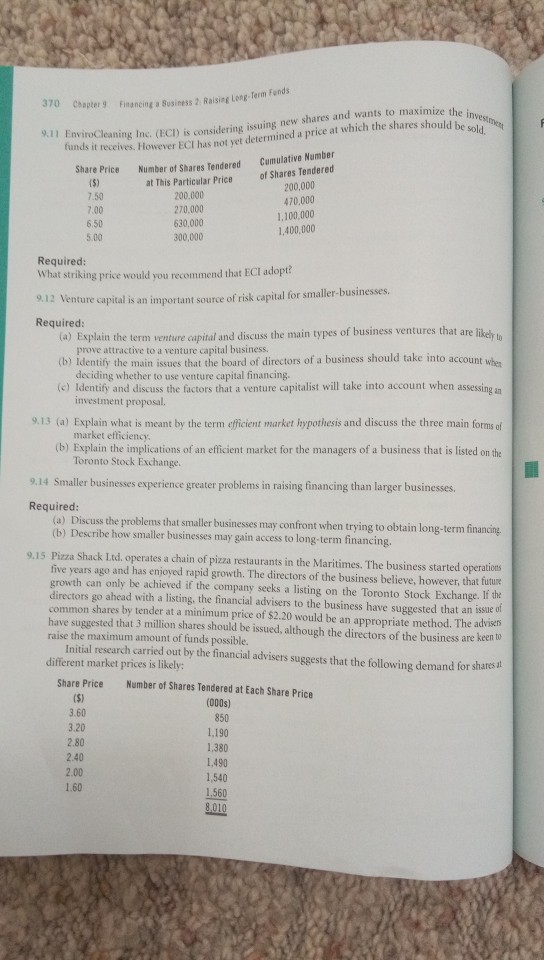

370 Chapter 9 Financing a Business 2 Raising Long- Term Fends ning Inc. (EC) is considering issuing new shares and wants to maximize the t receives. However ECI has not yet determined a price at which the shares should be in 9.11 En sold vroClea tunds i Number of Shares Tendered at This Particular Price Cumulative Number of Shares Tendered Share Price 7.50 6.50 0 270,000 630,000 300,000 200,000 470,000 1,100,000 1,400,000 5.00 Required: hat striking price would you recommend that ECI adopt? 9.12 V Required enture capital is an important source of risk capital for smaller-businesses (a) Exyplain the term venture capital and discuss the main types of business ventures that are liket t prove attractive to a venture capital business (b) Identify the main issues that the board of directors of a business should take into account whe eciding whether to use venture capital financing. (c) Identify and discuss the factors that a venture capitalist will take into account when assessing an investment proposal. 9.13 (a) Explain what is meant by the term eficient market hypothesis and discuss the three main forms of market efficiency (b) Explain the implications of an efficient market for the managers of a business that is listed on th 9.14 Smaller businesses experience greater problems in raising financing than larger businesses. Required: Toronto Stock Exchange. (a) Discuss the problems that smaller businesses may confront when trying to obtain long-term financing (b) Describe how smaller businesses may gain access to long-term financing. 9.15 Pizza Shack Ltd. operates a chain of pizza restaurants in the Maritimes. The business started operations five years ago and has enjoyed rapid growth. The directors of the business believe, however, that futue th can only be achieved if the company seeks a listing on the Toronto Stock Exchange. If the directors go ahead with a listing, the financial advisers to the business have suggested that an issue of common shares by tender at a minimum price of $2.20 would be an appropriate method. The advisen have suggested that 3 million shares should be issued, although the directors of the business are keen to raise the maximum amount of funds possible. Initial research carried out by the financial advisers suggests that the following demand for shares sit different market prices is likely: Share Price Number of Shares Tendered at Each Share Price 3.60 3.20 2.80 2.40 2.00 1.60 (000s) 850 1,190 1,380 1,490 1.560

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts