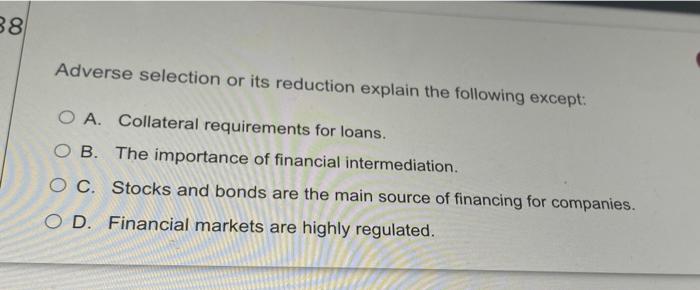

Question: 38 Adverse selection or its reduction explain the following except: O A. Collateral requirements for loans. O B. The importance of financial intermediation. OC. Stocks

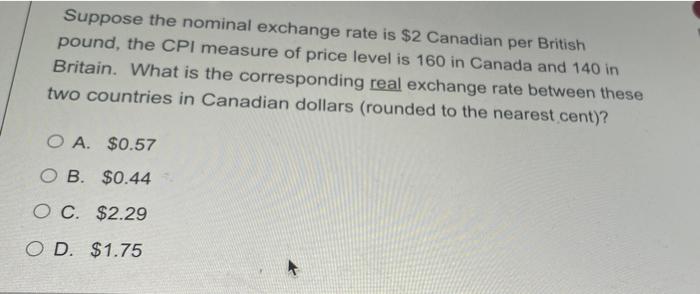

38 Adverse selection or its reduction explain the following except: O A. Collateral requirements for loans. O B. The importance of financial intermediation. OC. Stocks and bonds are the main source of financing for companies. OD. Financial markets are highly regulated. Suppose the nominal exchange rate is $2 Canadian per British pound, the CPI measure of price level is 160 in Canada and 140 in Britain. What is the corresponding real exchange rate between these two countries in Canadian dollars (rounded to the nearest cent)? O A. $0.57 OB. $0.44 OC. $2.29 OD. $1.75

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts