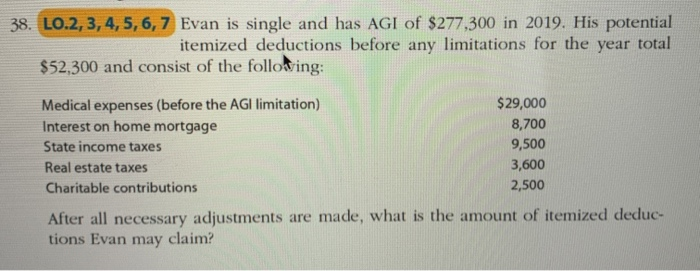

Question: 38. LO.2, 3, 4, 5, 6, 7 Evan is single and has AGI of $277,300 in 2019. His potential itemized deductions before any limitations for

38. LO.2, 3, 4, 5, 6, 7 Evan is single and has AGI of $277,300 in 2019. His potential itemized deductions before any limitations for the year total $52,300 and consist of the folloving: Medical expenses (before the AGI limitation) Interest on home mortgage $29,000 8,700 9,500 State income taxes 3,600 Real estate taxes 2,500 Charitable contributions After all necessary adjustments are made, what is the amount of itemized deduc- tions Evan may claim

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock