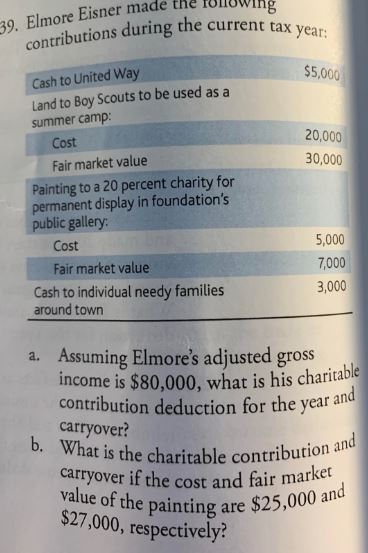

Question: 39. Elmore Eisner made the follo utions during the current tax year: contributions during $5,000 Cash to United Way Land to Boy Scouts to be

39. Elmore Eisner made the follo utions during the current tax year: contributions during $5,000 Cash to United Way Land to Boy Scouts to be used as a summer camp: 20,000 30,000 Cost Fair market value Painting to a 20 percent charity for permanent display in foundation's public gallery: Cost Fair market value Cash to individual needy families around town 5,000 7,000 3,000 a. Assuming Elmore's adjusted gross income is $80,000, what is his charitab contribution deduction for the year ar carryover? What is the charitable contribution carryover if the cost and fair ma T the painting are $25,000 an b. st and fair market value of the painting are $27,000, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts