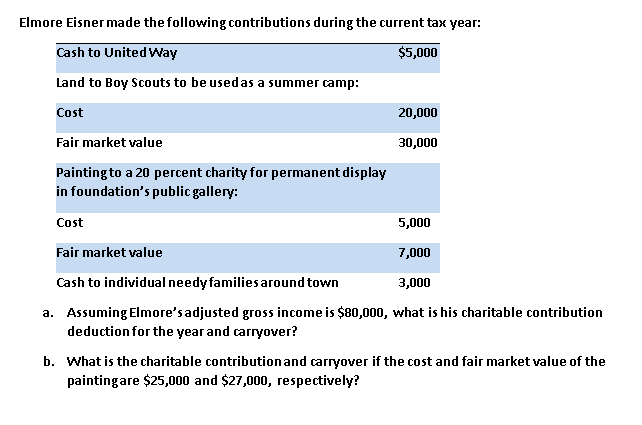

Question: Elmore Eisner made the following contributions during the current tax year: Cash to United Way $5,000 Land to Boy Scouts to be usedas a summer

Elmore Eisner made the following contributions during the current tax year: Cash to United Way $5,000 Land to Boy Scouts to be usedas a summer camp: Cost 20,000 30,000 Fair market value Painting to a 20 percent charity for permanent display in foundation's public gallery: Cost 5,000 Fair market value 7,000 Cash to individual needy families around town 3,000 a. Assuming Elmore's adjusted gross income is $80,000, what is his charitable contribution deduction for the year and carryover? b. What is the charitable contribution and carryover if the cost and fair market value of the paintingare $25,000 and $27,000, respectively

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts