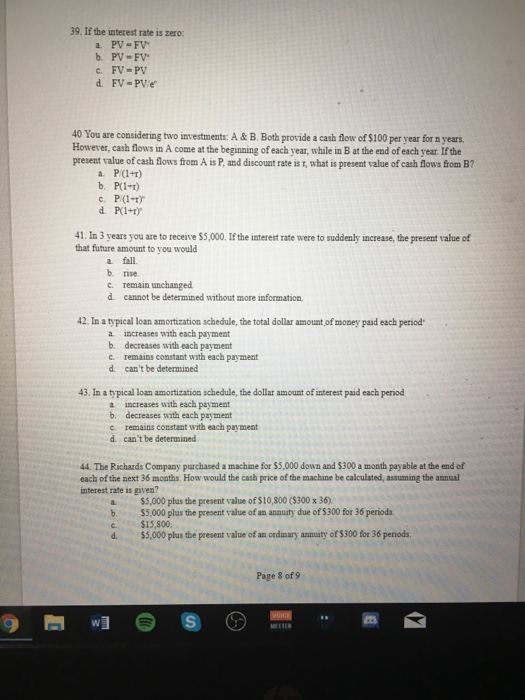

Question: 39. If the interest rate is zero: a PV-FV bPV-FV c. FV-P 0 You are considering two investments: A &B. Both provide a cash flow

39. If the interest rate is zero: a PV-FV bPV-FV c. FV-P 0 You are considering two investments: A &B. Both provide a cash flow of $100 per year for n years. However, cash flows in A come at the beginning of each year, while in B at the end of each year. If the present value of cash flows from A is P, and discount rate is r, what is present value of cash flows from B d P(1-T 41. In 3 years you are to receitve $5,000. If the interest rate were to suddenly increase, the present value of that future amount to you would a. fall b. rise c. remain unchanged d. cannot be determined without more information 42. In a typical loan amortization schedule, the total dollar amount of money paid each period a increases with each payment b. decreases with each payment c. remains constant with each payment d. can't be determined 43. In a typical loan amortization schedule, the dollar amount of interest paid each period a increases with each payment b. decreases with each payment c remains constant with each payment d. can't be determined 44. The Richards Company purchased a machine for $5,000 down and $300 a month payable at the end of each of the next 36 months. How would the cash price of the machine be calculated, assuming the annal interest rate is given? a $5,000 plus the present value of $10,800 ($300 x 36) b$5,000 plus the present value of an annuity due of $300 for 36 periods $15,800 d $5,000 plus the present value of an ordinary annuity of $300 for 36 periods. Page 8 of 9

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts