Question: 39 Practice Problems EOC Q2, 4, 6, 15, 21, 22, 30 22. Covered nerst Arbitrage in Both Directions. The following information is available: You have

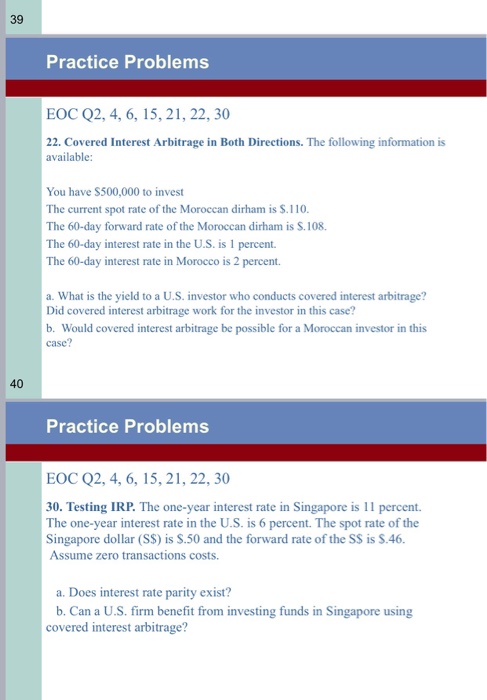

39 Practice Problems EOC Q2, 4, 6, 15, 21, 22, 30 22. Covered nerst Arbitrage in Both Directions. The following information is available: You have S500,000 to invest The current spot rate of the Moroccan dirham is $.110. The 60-day forward rate of the Moroccan dirham is S.108. The 60-day interest rate in the U.S. is 1 percent. The 60-day interest rate in Morocco is 2 percent. a. What is the yield to a U.S. investor who conducts covered interest arbitrage? Did covered interest arbitrage work for the investor in this case? b. Would covered interest arbitrage be possible for a Moroccan investor in this case? 40 Practice Problems EOC Q2, 4, 6, 15, 21, 22, 30 30. Testing IRP. The one-year interest rate in Singapore is 11 percent The one-year interest rate in the U.S. is 6 percent. The spot rate of the Singapore dollar (SS) is S.50 and the forward rate of the SS is S.46. Assume zero transactions costs. a. Does interest rate parity exist? b. Can a U.S. firm benefit from investing funds in Singapore using covered interest arbitrage

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts