Question: 39,500 and 6,500 are not the answer The wrong answer: -At the end of the second year, Amos's adjusted basis is $54000 and Buddy's adjusted

39,500 and 6,500 are not the answer

39,500 and 6,500 are not the answer

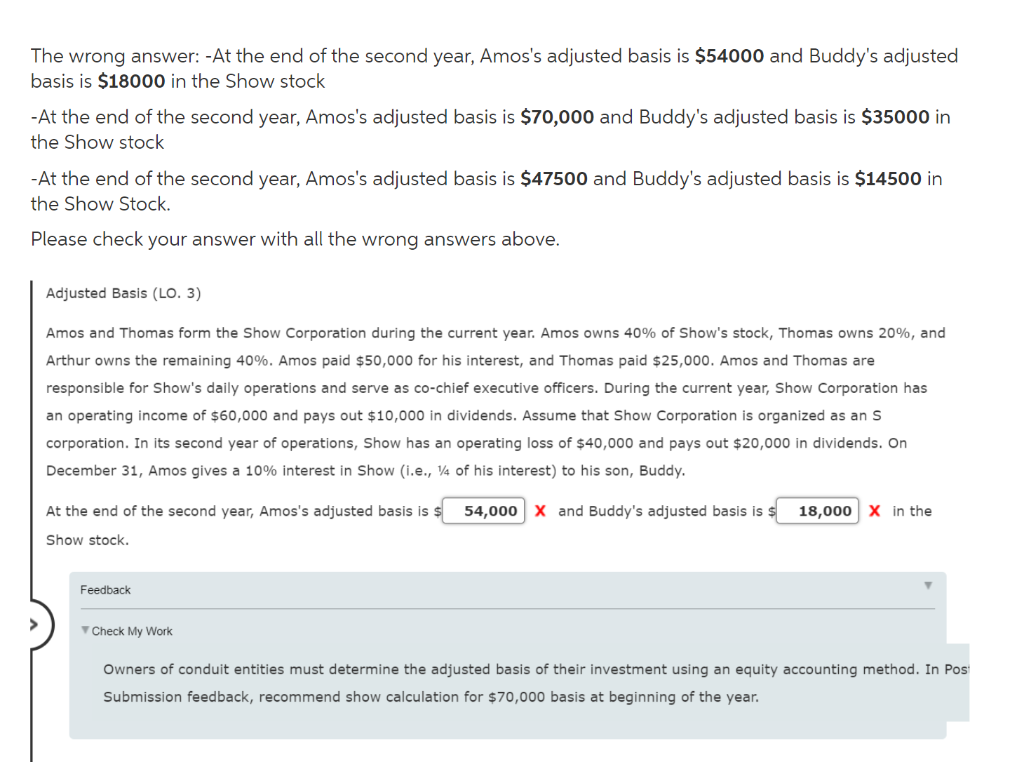

The wrong answer: -At the end of the second year, Amos's adjusted basis is $54000 and Buddy's adjusted basis is $18000 in the Show stock -At the end of the second year, Amos's adjusted basis is $70,000 and Buddy's adjusted basis is $35000 in the Show stock -At the end of the second year, Amos's adjusted basis is $47500 and Buddy's adjusted basis is $14500 in the Show Stock. Please check your answer with all the wrong answers above. Adjusted Basis (LO. 3) Amos and Thomas form the Show Corporation during the current year. Amos owns 40% of Show's stock, Thomas owns 20%, and Arthur owns the remaining 40%. Amos paid $50,000 for his interest, and Thomas paid $25,000. Amos and Thomas are responsible for show's daily operations and serve as co-chief executive officers. During the current year, Show Corporation has an operating income of $60,000 and pays out $10,000 in dividends. Assume that Show Corporation is organized as an S corporation. In its second year of operations, Show has an operating loss of $40,000 and pays out $20,000 in dividends. On December 31, Amos gives a 10% interest in Show (i.e., 14 of his interest) to his son, Buddy. 54,000 X and Buddy's adjusted basis is $ 18,000 X in the At the end of the second year, Amos's adjusted basis is $ Show stock. Feedback Check My Work Owners of conduit entities must determine the adjusted basis of their investment using an equity accounting method. In Pos Submission feedback, recommend show calculation for $70,000 basis at beginning of the year

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts