Question: 3a Hyper - go is considering buying a new water treatment system for its plant in Austin, Texas. The investment proposal passed the initial screcening

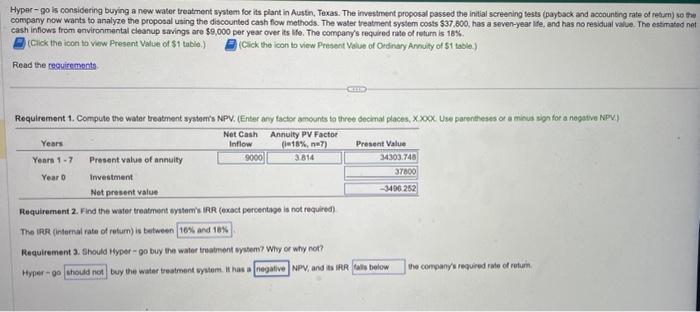

Hyper - go is considering buying a new water treatment system for its plant in Austin, Texas. The investment proposal passed the initial screcening tests (payback and accounting rate of resurn) so the corrpany now wants to analyze the proposal using the discounted cash flow methods. The water treatment system costs $37.800, has a seven-year lle. and has no residual value. The estimatod net cash inflows from environmental cleanup savings are $9,000 per year over its lif. The compary's required rale of return is 18S. (Cick the ioon to viow Present Value of $1 tablo.) (Cick the icon to view Present Value of Ordinary Anruily of \$1 table.) Read the reguitements Requirement 1. Compute the water treatment systemis NPV, (Enter any tactor amounts ta three decimal places, X. XocK. Use parontheses or a minus sign for a nogstiv NpV.) Requirement 2. Find the water treatment bystemis IRR (exact percentage is not required) The IRR (intemal rate of return) is twtween Requirement 3. Should Hyper - go buy the water treatront systers? Why or why not? Hyper - go buy the water treatment system. If has a NPV, and ts IRR the company's required rate of retum. Find the water treatment system's IRR (exact percentage is not required). al rate of return) is between Should Hyper-go buy the Nhy or why not? buy the water treat 16% and 18% NPV, and its IRR 12% and 14% 14% and 16% 10% and 12%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts