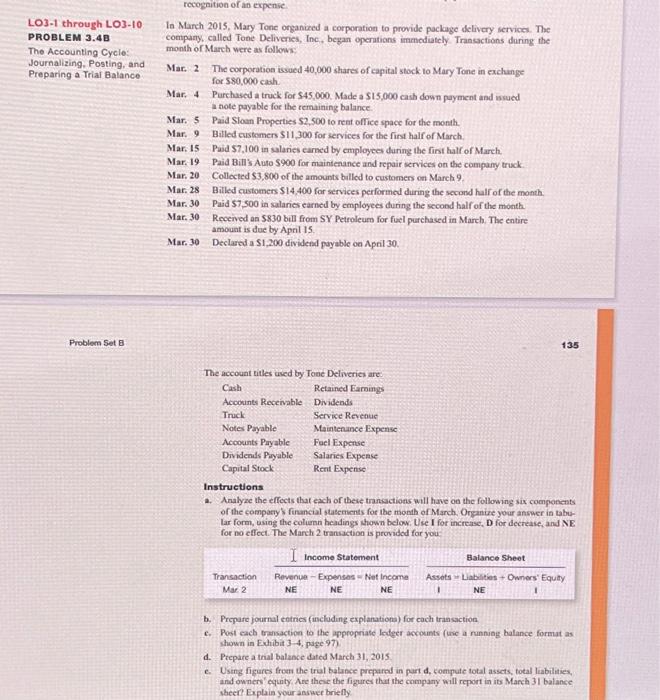

Question: LO3-1 through LO3-10 PROBLEM 3.4B The Accounting Cycle: Journalizing, Posting, and Preparing a Trial Balance Problem Set B recognition of an expense. In March 2015,

LO3-1 through LO3-10 PROBLEM 3.4B The Accounting Cycle: Journalizing, Posting, and Preparing a Trial Balance In March 2015, Mary Tone organized a corporation to provide package delivery services. The company, called Tone Deliveries, Ine, began operations immediately Transactions during the month or March were as follows: Mar. 2 The corporation issued 40,000 shares of capital slock to Mary Tone in exchange for 5$0,000cash. Mar. 4 Purchased a truck for $45,000. Made a $15,000 cash down payment and wsued a note payable for the remaining balance. Mar. 5 Paid Sloan Properties 52,500 to rent office space for the month. Mar. 9 Billed customers $11,300 for services for the first half of March. Mar, 15 Paid \$7,100 in salaries earned by employees during the fint half of March. Mar. 19 Paid Bill's Auto $900 for mainienance and repair services on the company truck Mar. 20 Collected $3,800 of the amounts billed to customen en Marela 9. Mar. 28 Billed customens $14,400 for services performed during the second half of the momth Mar. 30 Paid \$7,500 in salaries earned by employees during the second half of the month Mar. 30 Received an $830 bill from SY Petroleurs for fuel purchased in March. The entire amount is due by April 15. Mar. 30 Declarod a $1,200 dividend payable on April 30. Problem Set 8 135 The accouat titles used by Tone Deliverics are: Instruetions a. Aralyac the effects that each of theie transactions will have on the following six components of the company' financial statenients for ithe month of March. Organize your answer in tabular form, using the column beadings shown below: Use I for increase, D for decrease, and NE for no effect. The March 2 transiction is provided for you b. Prepare journal eatnes (including explanation) for cach transaction c. Post each transaction to the appropriate leder accounts (une a runniag balance formut as shown in Exhibit 3-4, puge 97) d. Prepare a tinal balance dated March 31, 2015 e. Using figures from the trial balance preparad in part d, compute total assets, total liabilities, and owners' equity. Ane these the figures that the crompany will report in its March 3 I balance sheef? Explain your answer briefly. LO3-1 through LO3-10 PROBLEM 3.4B The Accounting Cycle: Journalizing, Posting, and Preparing a Trial Balance In March 2015, Mary Tone organized a corporation to provide package delivery services. The company, called Tone Deliveries, Ine, began operations immediately Transactions during the month or March were as follows: Mar. 2 The corporation issued 40,000 shares of capital slock to Mary Tone in exchange for 5$0,000cash. Mar. 4 Purchased a truck for $45,000. Made a $15,000 cash down payment and wsued a note payable for the remaining balance. Mar. 5 Paid Sloan Properties 52,500 to rent office space for the month. Mar. 9 Billed customers $11,300 for services for the first half of March. Mar, 15 Paid \$7,100 in salaries earned by employees during the fint half of March. Mar. 19 Paid Bill's Auto $900 for mainienance and repair services on the company truck Mar. 20 Collected $3,800 of the amounts billed to customen en Marela 9. Mar. 28 Billed customens $14,400 for services performed during the second half of the momth Mar. 30 Paid \$7,500 in salaries earned by employees during the second half of the month Mar. 30 Received an $830 bill from SY Petroleurs for fuel purchased in March. The entire amount is due by April 15. Mar. 30 Declarod a $1,200 dividend payable on April 30. Problem Set 8 135 The accouat titles used by Tone Deliverics are: Instruetions a. Aralyac the effects that each of theie transactions will have on the following six components of the company' financial statenients for ithe month of March. Organize your answer in tabular form, using the column beadings shown below: Use I for increase, D for decrease, and NE for no effect. The March 2 transiction is provided for you b. Prepare journal eatnes (including explanation) for cach transaction c. Post each transaction to the appropriate leder accounts (une a runniag balance formut as shown in Exhibit 3-4, puge 97) d. Prepare a tinal balance dated March 31, 2015 e. Using figures from the trial balance preparad in part d, compute total assets, total liabilities, and owners' equity. Ane these the figures that the crompany will report in its March 3 I balance sheef? Explain your answer briefly

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts