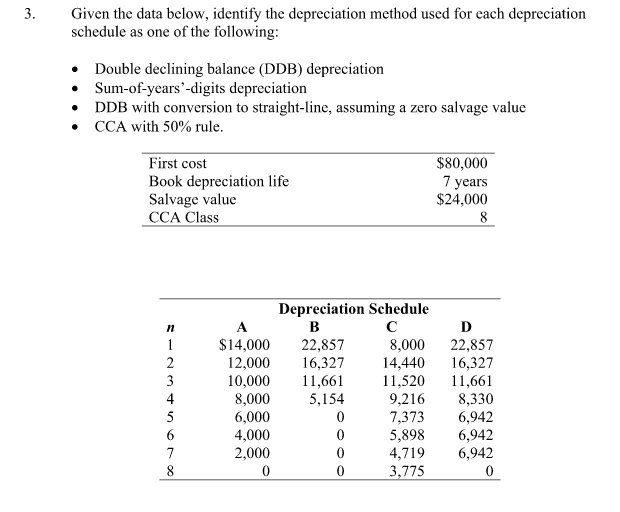

Question: 3.Given the data below, identify the depreciation method used for each depreciation schedule as one of the following Double declining balance (DDB) depreciation Sum-of-years'-digits depreciation

3.Given the data below, identify the depreciation method used for each depreciation schedule as one of the following Double declining balance (DDB) depreciation Sum-of-years'-digits depreciation DDB with conversion to straight-line, assuming a zero salvage value CCA with 50% rule First cost Book depreciation life Salvage value CCA Class $80,000 7 years $24,000 Depreciation Schedule $14,00022,857 8,000 22,857 12,000 16,327 14,440 16,327 11.66111,520 ,661 9,216 8.330 7,373 6,942 5,8986,942 4,719 6,942 8,000 6,000 4,000 2,000 5,154 3,775

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts