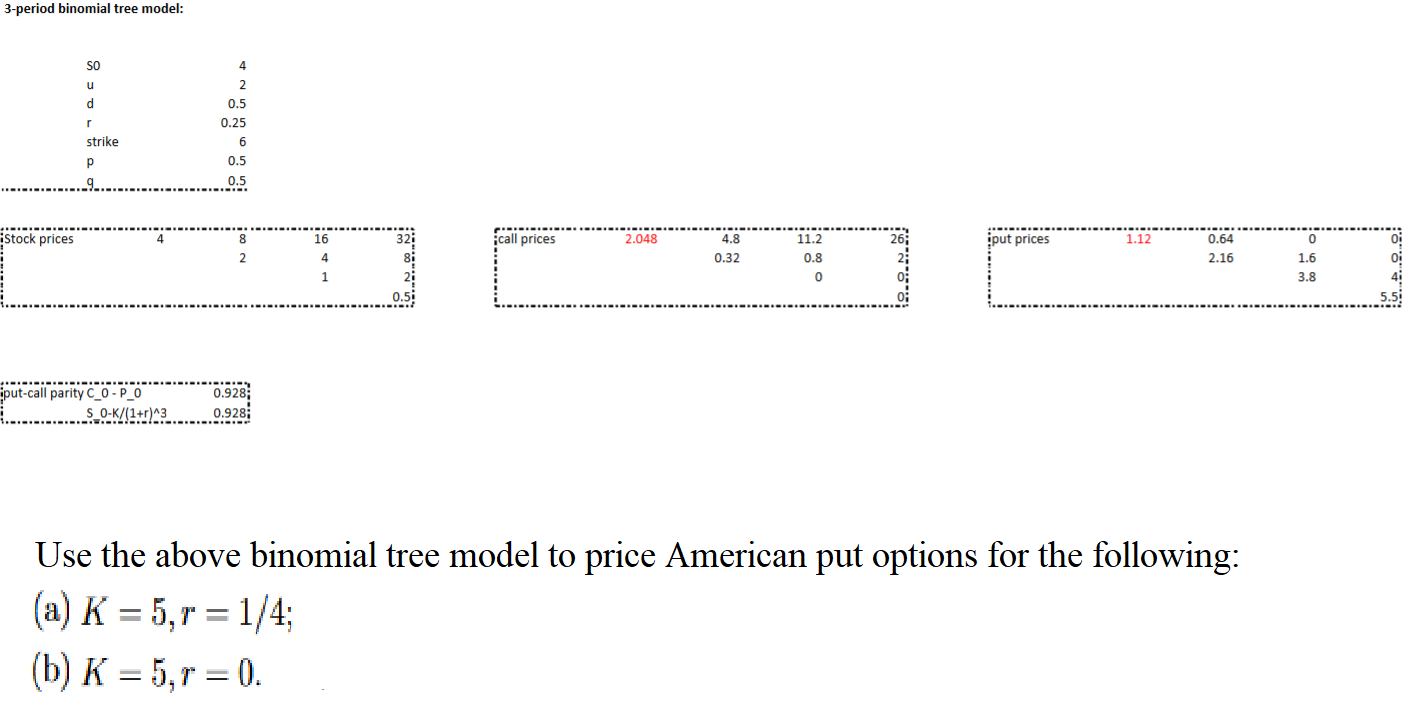

Question: 3-period binomial tree model: SO u d 4 2 0.5 0.25 r strike 6 0.5 0.5 Stock prices call prices 2.048 11.2 4.8 0.32 put

3-period binomial tree model: SO u d 4 2 0.5 0.25 r strike 6 0.5 0.5 Stock prices call prices 2.048 11.2 4.8 0.32 put prices 1.12 0.64 2.16 0.8 0 900 0 1.6 3.8 put-call parity C_O-P_O S_O-K/(1+r)^3 0.928 0.9287 Use the above binomial tree model to price American put options for the following: (a) K = 5, r = 1/4; (b) K = 5,7 = 0. 3-period binomial tree model: SO u d 4 2 0.5 0.25 r strike 6 0.5 0.5 Stock prices call prices 2.048 11.2 4.8 0.32 put prices 1.12 0.64 2.16 0.8 0 900 0 1.6 3.8 put-call parity C_O-P_O S_O-K/(1+r)^3 0.928 0.9287 Use the above binomial tree model to price American put options for the following: (a) K = 5, r = 1/4; (b) K = 5,7 = 0

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts