Question: a) Compute the contract value, initial margin and maintenance margin. b) Prepare marked-to-market position. c) Compute the profit loss in day 6 if there is

-

a) Compute the contract value, initial margin and maintenance margin.

-

b) Prepare marked-to-market position.

-

c) Compute the profit loss in day 6 if there is a commission of RM105 per contract.

-

d) Determine the leverage investment in day 6.

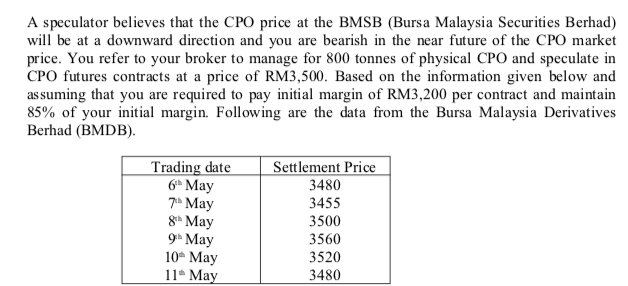

A speculator believes that the CPO price at the BMSB (Bursa Malaysia Securities Berhad) will be at a downward direction and you are bearish in the near future of the CPO market price. You refer to your broker to manage for 800 tonnes of physical CPO and speculate in CPO futures contracts at a price of RM3,500. Based on the information given below and assuming that you are required to pay initial margin of RM3,200 per contract and maintain 85% of your initial margin. Following are the data from the Bursa Malaysia Derivatives Berhad (BMDB). A speculator believes that the CPO price at the BMSB (Bursa Malaysia Securities Berhad) will be at a downward direction and you are bearish in the near future of the CPO market price. You refer to your broker to manage for 800 tonnes of physical CPO and speculate in CPO futures contracts at a price of RM3,500. Based on the information given below and assuming that you are required to pay initial margin of RM3,200 per contract and maintain 85% of your initial margin. Following are the data from the Bursa Malaysia Derivatives Berhad (BMDB)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts