Question: 3rd drop down selection: a lump sum, an interest-only, a life income, a fixed-amount, a fixed-period 4th drop down selection: Unfortunately, if you die before

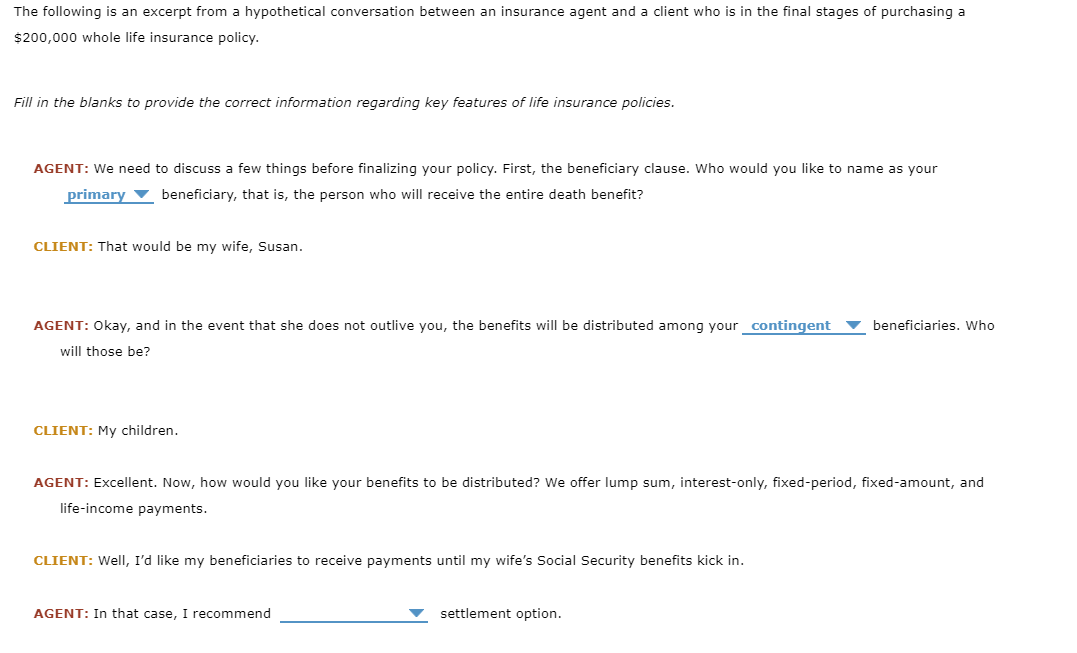

3rd drop down selection: a lump sum, an interest-only, a life income, a fixed-amount, a fixed-period

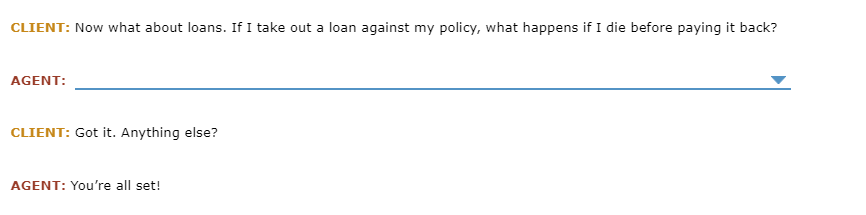

4th drop down selection: Unfortunately, if you die before you pay back your loans, the policy is voided OR the value of the loan plus interest will simply be subtracted from the proceeds of the policy

The following is an excerpt from a hypothetical conversation between an insurance agent and a client who is in the final stages of purchasing a $200,000 whole life insurance policy. Fill in the blanks to provide the correct information regarding key features of life insurance policies. AGENT: We need to discuss a few things before finalizing your policy. First, the beneficiary clause. Who would you like to name as your primary beneficiary, that is, the person who will receive the entire death benefit? CLIENT: That would be my wife, Susan. AGENT: Okay, and in the event that she does not outlive you, the benefits will be distributed among your contingent beneficiaries. Who will those be? CLIENT: My children. AGENT: Excellent. Now, how would you like your benefits to be distributed? We offer lump sum, interest-only, fixed-period, fixed-amount, and life-income payments. CLIENT: Well, I'd like my beneficiaries to receive payments until my wife's Social Security benefits kick in. AGENT: In that case, I recommend settlement option. CLIENT: Now what about loans. If I take out a loan against my policy, what happens if I die before paying it back? AGENT: CLIENT: Got it. Anything else? AGENT: You're all set

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts