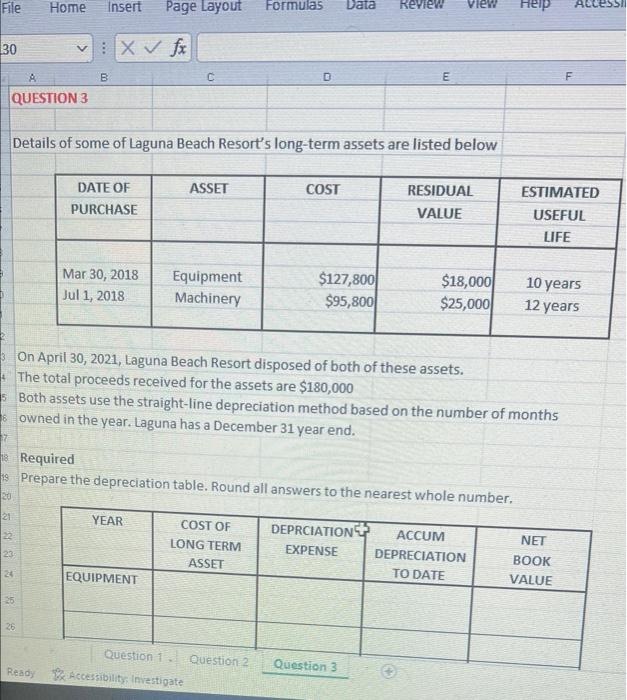

Question: 3rd File Home Insert Page Layout Formulas Data Review View Help 30 VX / fx A B C D E F QUESTION 3 Details of

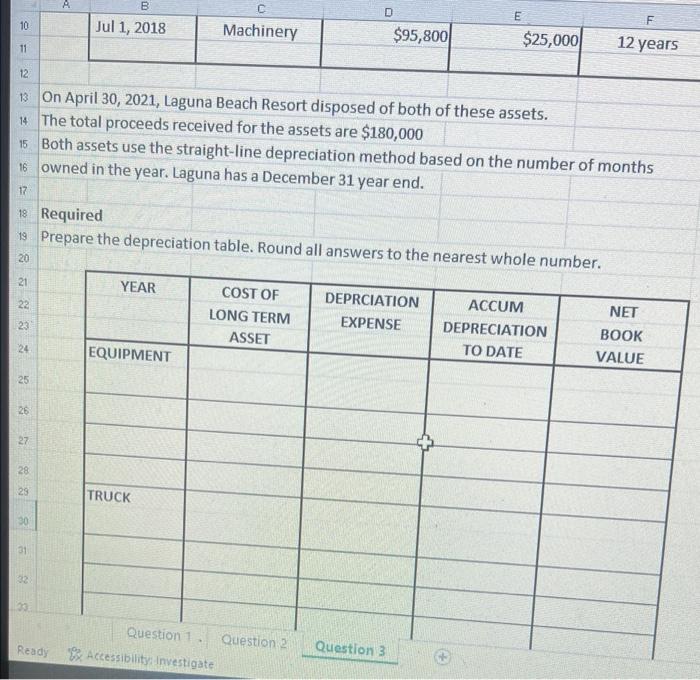

File Home Insert Page Layout Formulas Data Review View Help 30 VX / fx A B C D E F QUESTION 3 Details of some of Laguna Beach Resort's long-term assets are listed below ASSET COST DATE OF PURCHASE RESIDUAL VALUE ESTIMATED USEFUL LIFE Mar 30, 2018 Jul 1, 2018 Equipment Machinery $127,800 $95,800 $18,000 $25,000 10 years 12 years On April 30, 2021, Laguna Beach Resort disposed of both of these assets. The total proceeds received for the assets are $180,000 Both assets use the straight-line depreciation method based on the number of months owned in the year. Laguna has a December 31 year end. 17 Required Prepare the depreciation table. Round all answers to the nearest whole number, 20 21 YEAR COST OF DEPRCIATION ACCUM NET 22 LONG TERM EXPENSE DEPRECIATION BOOK 23 ASSET TO DATE VALUE 24 EQUIPMENT 26 Question 1 Question 2 Ready Accessibility Investigate Question 3 B Jul 1, 2018 E 10 F Machinery D $95,800 $25,000 11 12 years 12 13 On April 30, 2021, Laguna Beach Resort disposed of both of these assets. 14 The total proceeds received for the assets are $180,000 15 Both assets use the straight-line depreciation method based on the number of months 16 owned in the year. Laguna has a December 31 year end. 17 18 Required 19 Prepare the depreciation table. Round all answers to the nearest whole number. 20 21 YEAR 22 COST OF LONG TERM ASSET DEPRCIATION EXPENSE 23 ACCUM DEPRECIATION TO DATE NET BOOK VALUE 24 EQUIPMENT 25 26 27 28 29 TRUCK 30 31 32 29 Question 1 Question 2 Ready. Accessibility: Investigate Question 3

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts