Question: 4 - 1 Kiwi Builders, Ltd . In May 2 0 1 8 , Kiwi Builders, Ltd . was employed by the government of Hamilton,

Kiwi Builders, Ltd

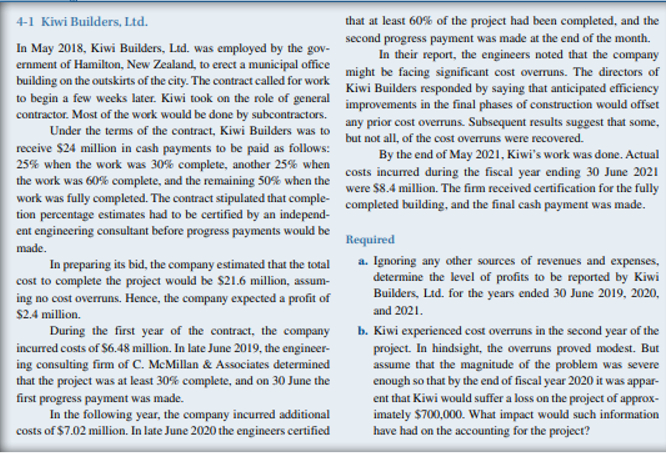

In May Kiwi Builders, Ltd was employed by the government of Hamilton, New Zealand, to erect a municipal office building on the outskirts of the city. The contract called for work to begin a few weeks later. Kiwi took on the role of general contractor. Most of the work would be done by subcontractors.

Under the terms of the contract, Kiwi Builders was to receive $ million in cash payments to be paid as follows: when the work was complete, another when the work was complete, and the remaining when the work was fully completed. The contract stipulated that completion percentage estimates had to be certified by an independent engineering consultant before progress payments would be made.

In preparing its bid, the company estimated that the total cost to complete the project would be $ million, assuming no cost overruns. Hence, the company expected a profit of $ million.

During the first year of the contract, the company incurred costs of $ million. In late June the engineering consulting firm of C McMillan & Associates determined that the project was at least complete, and on June the first progress payment was made.

In the following year, the company incurred additional costs of $ million. In late June the engineers certified

that at least of the project had been completed, and the second progress payment was made at the end of the month.

In their report, the engineers noted that the company might be facing significant cost overruns. The directors of Kiwi Builders responded by saying that anticipated efficiency improvements in the final phases of construction would offset any prior cost overruns. Subsequent results suggest that some, but not all, of the cost overruns were recovered.

By the end of May Kiwi's work was done. Actual costs incurred during the fiscal year ending June were $ million. The firm received certification for the fully completed building, and the final cash payment was made.

Required

a Ignoring any other sources of revenues and expenses, determine the level of profits to be reported by Kiwi Builders, Ltd for the years ended June and

b Kiwi experienced cost overruns in the second year of the project. In hindsight, the overruns proved modest. But assume that the magnitude of the problem was severe enough so that by the end of fiscal year it was apparent that Kiwi would suffer a loss on the project of approximately $ What impact would such information have had on the accounting for the project?

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock