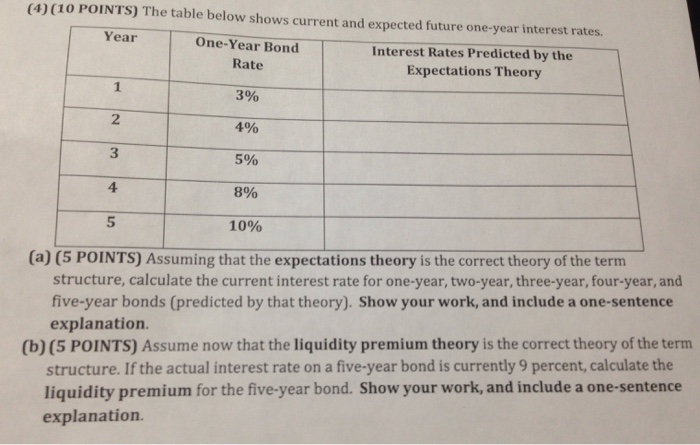

Question: (4) (10 POINTS) The table below shows current and expected future one-year interest rates Year One-Year Bond Rate 3% 4% 5% 8% 10% Interest Rates

(4) (10 POINTS) The table below shows current and expected future one-year interest rates Year One-Year Bond Rate 3% 4% 5% 8% 10% Interest Rates Predicted by the Expectations Theory 2 3 4 5 (a) (5 POINTS) Assuming that the expectations theory is the correct theory of the term structure, calculate the current interest rate for one-year, two-year, three-year, four-year, and five-year bonds (predicted by that theory). Show your work, and include a one-sentence explanation (b) (5 POINTS) Assume now that the liquidity premium theory is the correct theory of the term structure. If the actual interest rate on a five-year bond is currently 9 percent, calculate the liquidity premium for the five-year bond. Show your work, and include a one-sentence explanation

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts