Question: 4. (14 points) As a speculator you feel the Silver market may start to rise again so you decide to take a long position in

4. (14 points) As a speculator you feel the Silver market may start to rise again so you decide to take a long position in 1 September Silver contract at a price of 15.213 dollars per troy oz. on Monday morning. Suppose the initial margin is $16,875 per contract and the maintenance margin is $14,000 per contract. Calculate the marking to market and daily balance in the account for each day, and assume you close out the position on Friday. Is a margin call ever necessary? ( If it is, how much is the variation margin? Assume you pay it and continue on with the contract).

A futures contract is for 5,000 troy oz.

Settle price

Time ($/oz.) M-to-M Balance Margin Call

Monday am 16,875

Monday pm 15.103

Tuesday pm 14.582

Wednesday pm 14.954

Thursday pm 15.629

Friday pm 15.895

Close out position

________________________________________________________________________

What is your overall net profit if you paid an $75 round trip commission charge?

What is the overall profit for someone who sold the contract with the same commission charge?

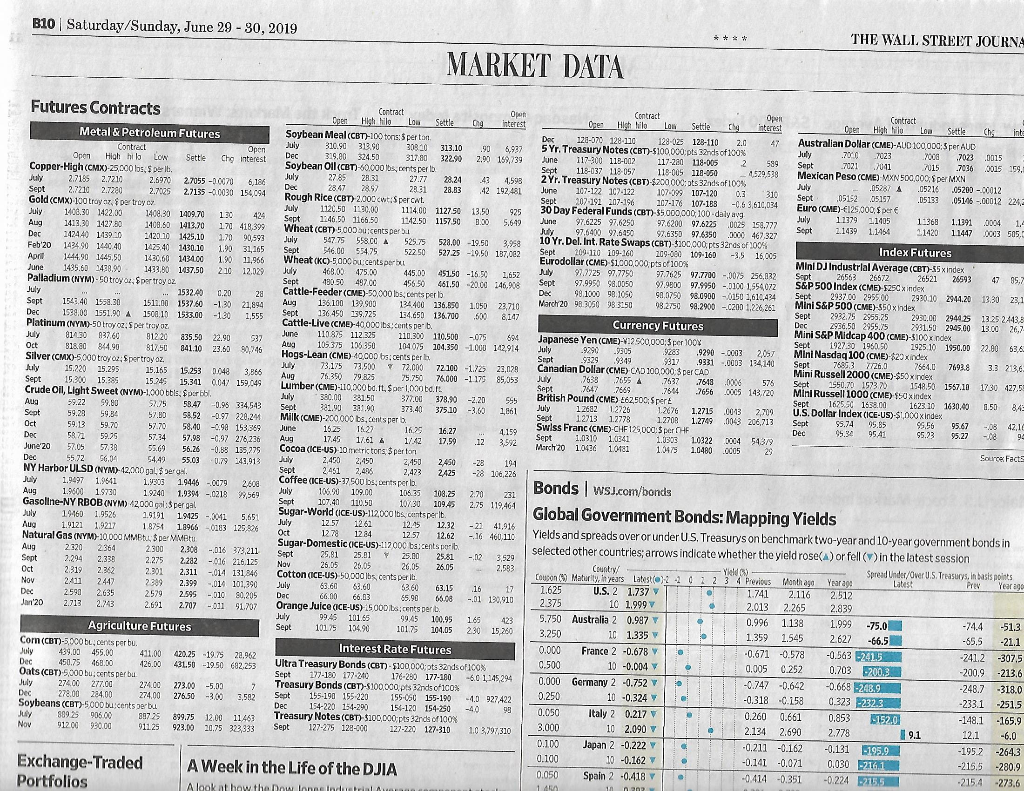

B10 Saturday/Sunday, June 29 - 30, 2019 THE WALL STREET JOURNA MARKET DATA Futures Contracts Out Contract Ones High Milo Lom Settle interest Dec 128-070 128-170 128-025 128-110 2.0 47 5 Yr. Treasury Notes (CBT)-5100,000 pls 3rds of 100% June 117-300 113-002 1 17-220 118-005 2 589 Sept 118-037 118-057 118-005 120-050 -4.529,538 2 Yr. Treasury Notes (CBT) $200 000: pts 32nds of 100% June 107-122 107-122 07-099 107-1200 3 310 Sept 102.391 107-16 107-176 102.183 -05351234 30 Day Federal Funds (CBT) $5.000.000, 100 daly avg June 97.6225 97.6250 97.6200 97.6225 .0025 158.777 JY 97.6400 92.6950 9 .6350 97.6350 000 462.327 10 Yr. Del. Int. Rate Swaps (CBT) $100,000 ps 32res of 100% Sept 109 110 109-166 1 08-000 100-160 -35 16.005 Eurodollar (CME) $1000000 pts of 100% . July 97.7725 97.7750 97.7625 97.7700 - 3075 256,022 Sept 97.9950 98.0050 92.980997.9950 - 0100 1554072 DE 99.1000 98.1050 0 0790 88.0900 - 0150 1616.424 March 2098 2050 98350 93.275 99.2900 -0200 1726.26 Contract Open High No Loo Settle c h inte Australian Dollar (CME)-AUD 100,000-5per AUD July 706 723 700 7023 3015 Sept 021 .2041 2015 .7036 159, Mexican Peso (CME) MXN 500,000 per MXN 05787 0 5216 05200 - 00012 Sept 15152 05157 05132 0514-00012 224 Euro (CME)-125.000pere July 11379 1.1905 11368 1.1391 0004 1, Sept 2.1439 1.1464 1420 1.1447 0003 505. May Metal & Petroleum Futures Contract Open Open High hib Low Settle Cho interest Copper-High (CMX) 25,000 lbs, Sperl, 2.7155 2.7210 2.6970 2.7055 -0.0070 6,186 Sept 2.7210 2.7280 2 .7005 27135 -0.0030 154094 Gold (CMX0-100 tray az, pe trey July 1408.30 1422.39 3408.30 1409.70 130 424 Aug 1413.30 1427.30 1 409.50 1413.70 171 418.399 Dec 142440 1430 1420.10 1425.10 1.20 00593 Feb 20 14340 144040 142540 1430.10 1.90 31,165 April 1444,90 1445.50 1430.60 143400 190 11,956 June 1435.50 2438.90 3433,80 1637.50 230 12.029 Palladium (NYM)-50 try 02, $per troy oz July . 1532.40 0.20 29 Sept 1543 46 1550.30 1511.00 1537.50 -130 21,894 Dec 1598.0 1951.904 1908.10 1533.00 -130 1.555 Platinum (NYM)-50 troy oz. Sper troy az July $14.30 037.60 01220 835.50 22.90 532 Oct $18.60 844.90 $17.50 841.10 23.60 90.746 Silver (CMX-5000 troy: Spertroy oz. July 15.220 25.295 15.155 15.253 .048 3,866 Sept 15300 15.385 15.745 15.341 0.047 159,049 Crude Oil, Light Sweet (NYM)-1,000 btls, $par bbl. Aug 59.22 59.80 52.75 58.47 -0.95 324,543 Sept 59.29 59.84 5 7.30 58.52 -0.97 220-24 59.3 59.70 57.70 58.40 -0.98 153359 Der R2 59.75 57.34 $7.98 -0,97 276,236 June 2057.0557,38 55.60 56.26 -0.88 135,275 Dec 55.72 6,34 5449 55.03 0.79 143,913 NY Harbor ULSD (NYM-2000 July 1.9497 1.9541 1.9903 19445-0079 2.500 Aug 1.9600 1973 19240 1.9394 -0218 99,569 Gasoline-NY RBOB (NYM) 42000 gal:Spergal July 19460 1.9526 1.9101 19425 - 3041 5,651 Aug 19122 1921 18751 19966-0183 125326 Natural Gas (NYM10,000 MM , S per MB Aug 2.320 2.364 2.300 2.308 .016 373,211 Srpt 2.294 2.338 2.225 2.282 -016 216.125 2.319 2.42 2 .301 2.311 -014 131 846 Now 2:01 2447 2009 2399 14 101290 Dec 2.590 2635 2579 2.595 .90 80,205 Jan 20 273 2743 2.691 2.707 -31 91.707 Contract Open Oper High Milo Low Settle og interest Soybean Meal (CBT)-100 tons: Spertan July 310.56 313.90 30826 313.10 .50 997 Dec 3.80 324.53 317.80 322.90 2.90 152,739 Soybean Oil (CBT)-50.000 lbs, cents per lb 2785 20.31 2 7.77 28.24 43 4,593 2847 282 283 28.83 42 192 481 Rough Rice (CBT) 2000 cnt:Speront July 1120.50 1.300 1134.00 1127.50 13.5) 925 Sept 1.46.59 1166.50 1342.50 1157.50 0.30 5.649 Wheat (CBT) 5000 u cents per bu July 547 75 558.CC 525.75 528.00 -19.50 3,958 Sept 346.0055475 522 50 527.25 -19.50 187,082 Wheat (KC) 5000 bucents perbu July 460.00 475. 0 4 45.3) 451.50 -15 0 1,652 Sept 130.50 497.00 45690 461.50 20.00 146,908 Cattle-Feeder (CVE) 50,000 lbs, cents per Aug 136.100 139.900 134.400 236.850 1.050 22.710 Sept 136450 339.725 54.650 136.700 5808147 Cattle-Live CME)-40.000 lbs. cents perb. June 110 875 112.325 110.300 110.500 -075 894 Aug 105375 136350 104075 104.350 1.000 142,914 Hogs-Lean (CME)-40,000 bs.cents perhe N 35 35 * L M - L Aug 76.350 79.825 75.750 76.000 -1.17585,353 Lumber (CME)-110,000 bd. 11. Sper 1.000 bd. July 380.00 331.50 377.00 378.90 -2.20 555 Seot 31. 33.00 373.40 375.10 -3.60 1661 Milk (CE)-200.000 bs,cents per a June 1525 1527 16.25 16.27 Aug 17.45 17.61 4 1742 17.59 123,592 Cocoa (ICE-US) 10 metric tons $perton July 2.450 2450 2450 2,450 -28 1 94 2451 2,286 2,4232 425 -28 3.6.225 Coffee ICE-US)-27 500 bsperts per July 106.90 109.00 105.35 108.25 2.70 231 Sept 107.40 110.50 107.30 109.45 2.75 119,464 Sugar-World (ICE-US)-112.000 lbs. contsperit. July 12.57 1261 1245 12.32 -21 41.916 Oct 1278 1284 12:57 12.62 -36 460 110 Sugar-Domestic (ICE-US)-117000 bs.centsporib Sept 25.81 25.01 25.00 25.81 -12 3,529 Nov 26.05 26.05 26.05 28.05 2.583 Cotton (ICE-US) 50.000 lbs. cents per 63.6663.60 966 63.15 16 17 Dec 66.00 66.03 $5.90 65.08 -31 130,910 Orange Juice (ICE-US) 15,00Discents per July 09:45 101.65 995 100.95 165 423 Sept 101.75 15496 101.75 104.05 230 15 260 Currency Futures Japanese Yen (CME)-V.2 500,000:$per 100 July 929 9305 9283 .9290 -0003 2,057 Sept 929 9949 9 317 9331-0003 134 140 Canadian Dollar (CME) CAD 300,000 $ per CAD July 7638 7695 A 7637 7643 .0006 576 Sept . 7647 7669 7664 7656 0005 143,720 British Pound (CME> E62,500:spert July 1248212726 1.2676 1.271500132,709 Sept 1213 12778 17708 1.2709 943 204,713 Swiss Franc (CME-CHF 125.000 $ per CHF Sept 1.0310 10341 1.0303 10322 3004 543/9 March 2010476 10181 1.0475 1.0480 0005 29 Index Futures Mini DJ Industrial Average (CBT)-55x index Sept 26563 26572 26521 26593 4785,7 S&P 500 Index (CME) 5250 x index Sept 2937.00 295500 2930.10 2944.20 1330 231 Mini S&P 500 (CME)-550 x index Sept 2932.75 2955.75 2930.00 29415132524438 Dec 2936.50 2955.75 2931.50 2945.00 13.00 26,7 Mini S&P Midcap 400 (CME)-S100x index Sept1927-30 1960.90 2925 10 1950.00 22.00 63,6 Mint Nasdaq 100 (CME)-$20 x index Sept76863 7/26.0 756407493833 2136 Mini Russell 2000 (CME)-$50 x index Sept 1550.70 157370 1548.50 1557.10 17.30 427.5 Mini Russell 1000 (CME) 90 x index Sept 162590 1698.00 1623.10 1630.40 1.50 849 U.S. Dollar Index (ICE-US)-ST.000 x index Sept 55.74 5.5 95.56 95.67 -08 12.10 95.23 95.27 -089 4.159 Dec Source Facts Sept -- Yield Latest Agriculture Futures Corn (CBT)-5000bucents per bu July 439.00 455.00 411.00 420.25 -19.75 28,962 Dec 450.75 460.00 426.00 431.50 -19.50 692.253 Oats (CBT) 5,000 bucents per bu July 27400 27700 2 7400 223.00 -5.00 Dec 278.00 284,00 274,00 276.50 -3.6 3582 Soybeans (CBT)-5.000 bucents perbu July 899.25 90500 9 0725 899.75 12.00 11463 Nov 9120000.00 91125922.00 20.75 323.833 Bonds WSJ.com/bonds Global Government Bonds: Mapping Yields Yields and spreads over or under U.S. Treasurys on benchmark two-year and 10-year government bonds in selected other countries; arrows indicate whether the yield rose(A) or fell in the latest session Country Spread Under/Over U.S. Treasurys, inasis points Coupon Maturity. In years Latest(o)- 2 012 3 4 Previous Month ago Year ago Pre Year 1.625 U.S. 2 1.737 1.741 2.116 2.512 2375 1 0 1.999 V 2.013 2.265 2.839 5.750 Australia 2 0.987 0.996 1138 1.999 -75.0 -74.4 -51.3 3.250 10 1.335 1.359 1.545 2.627 -66.5 -65.5 -21.1 0.000 France 2 -0.678 -0.671 -0.578 -0.563 2015 -241.2 -307. 0.500 10 -0.004 0.005 0.252 0.703 5200.3 -200.9 -213. 0.000 Germany 2 -0.752 -0.747 -0.642 -0.668 -248.9 -248.7 -318. 0.250 10 -0.324 -0.318 0.158 0.323 32323 -233.1 -251. 0.050 Italy 2 0.217 V 0.260 0.661 0.853 152.0 -148.1 -165. 3.000 10 2.090 Y 2.134 2.690 2.778 19.1 12.1 -6.0 0.100 Japan 2 -0.222 -0.211 -0.162 -0.131 $195.9 -195.2 -264 0.100 10 -0.162 -0.141 -0.071 0.030 5261 -215.5 -280 0.050 Spain 2 -0.418 Y -0.414 -0.351 -0.224 275 -215.4 273. 1 Interest Rate Futures Ultra Treasury Bonds (CBT)- $100,000;ots 32nds of 100% Sept 177-180 177-240 176-280 177-180 -60 1,145,294 Treasury Bonds (CBT)-$100.000 pts indso100% Sept 155-190 155-220 155-050 155-190 1 927.422 Dec 154-220 154-290 156-120 154-250 -40 98 Treasury Notes (CBT) $100,000pts 3rd of 100% Sept 127-275 128-000 1 27-220127.310103797310 Exchange-Traded Dortfolios A Week in the Life of the DJIA

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts