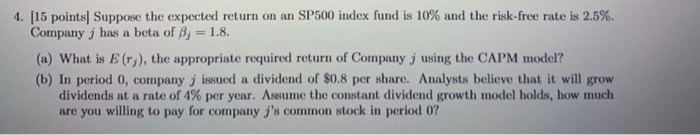

Question: 4. (15 points Suppose the expected return on an SP500 index fund is 10% and the risk-free rate is 2.5%. Company has a beta of

4. (15 points Suppose the expected return on an SP500 index fund is 10% and the risk-free rate is 2.5%. Company has a beta of B; = 1.8. (a) What is E (r), the appropriate required return of Company j using the CAPM model? (b) In period 0, company issued a dividend of $0.8 per share. Analysts believe that it will grow dividends at a rate of 4% per year. Assume the constant dividend growth model holds, how much are you willing to pay for company j's common stock in period 07

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts