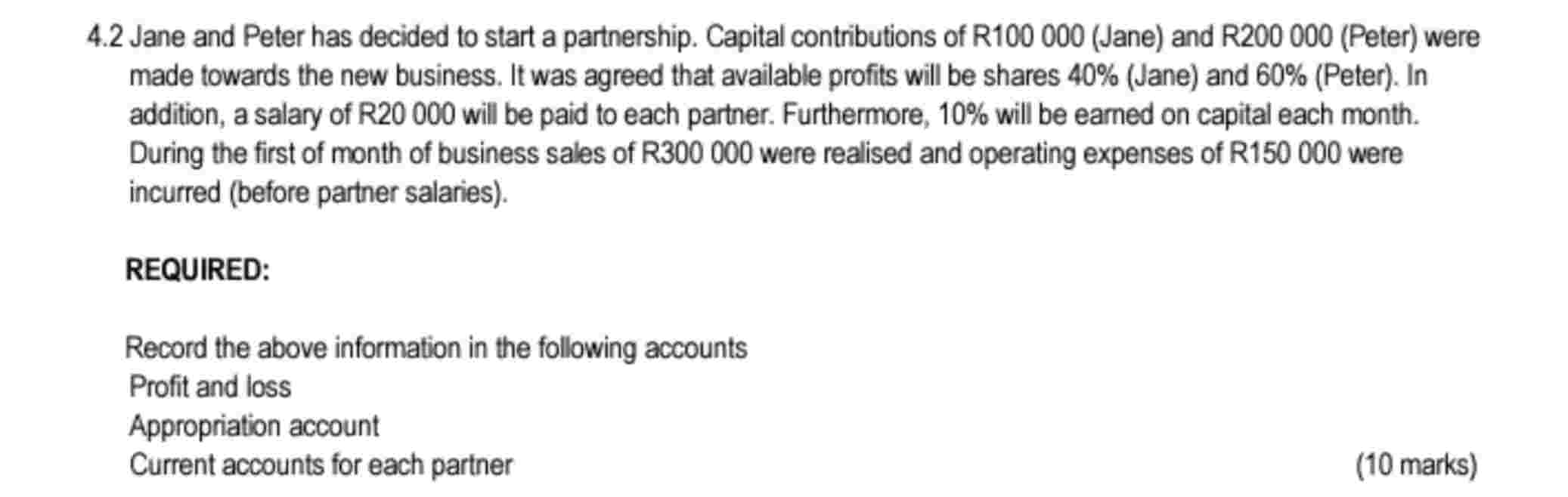

Question: 4 . 2 Jane and Peter has decided to start a partnership. Capital contributions of R 1 0 0 0 0 0 ( Jane )

Jane and Peter has decided to start a partnership. Capital contributions of RJane and RPeter were made towards the new business. It was agreed that available profits will be shares Jane and Peter In addition, a salary of R will be paid to each partner. Furthermore, will be earned on capital each month. During the first of month of business sales of R were realised and operating expenses of R were incurred before partner salaries REQUIRED: Record the above information in the following accounts Profit and loss Appropriation account Current accounts for each partner

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock