Question: 4. (20 points) Consider an American call option when the stock price is $18, the exercise price is $20, the time to maturity is 6

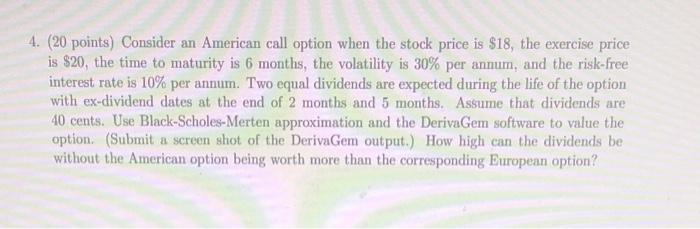

4. (20 points) Consider an American call option when the stock price is $18, the exercise price is $20, the time to maturity is 6 months, the volatility is 30% per annum, and the risk-free interest rate is 10% per annum. Two equal dividends are expected during the life of the option with ex-dividend dates at the end of 2 months and 5 months. Assume that dividends are 40 cents. Use Black-Scholes-Merten approximation and the DerivaGem software to value the option. (Submit a screen shot of the Derivagem output.) How high can the dividends be without the American option being worth more than the corresponding European option

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts