Question: Part A (15 Marks Consider an American call option when the stock price is $50, the exercise price is $55, the time to maturity is

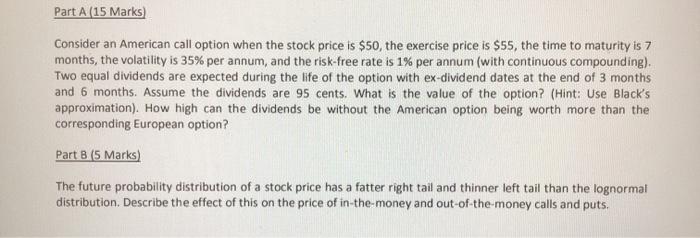

Part A (15 Marks Consider an American call option when the stock price is $50, the exercise price is $55, the time to maturity is 7 months, the volatility is 35% per annum, and the risk-free rate is 1% per annum (with continuous compounding). Two equal dividends are expected during the life of the option with ex-dividend dates at the end of 3 months and 6 months. Assume the dividends are 95 cents. What is the value of the option? (Hint: Use Black's approximation). How high can the dividends be without the American option being worth more than the corresponding European option? Part B (5 Marks) The future probability distribution of a stock price has a fatter right tail and thinner left tail than the lognormal distribution. Describe the effect of this on the price of in-the-money and out-of-the-money calls and puts

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts