Question: 4. (30 points) This question asks you to price various options with one year to expiry on XYZCorp stock, which is non-dividend-paying. The interest rate

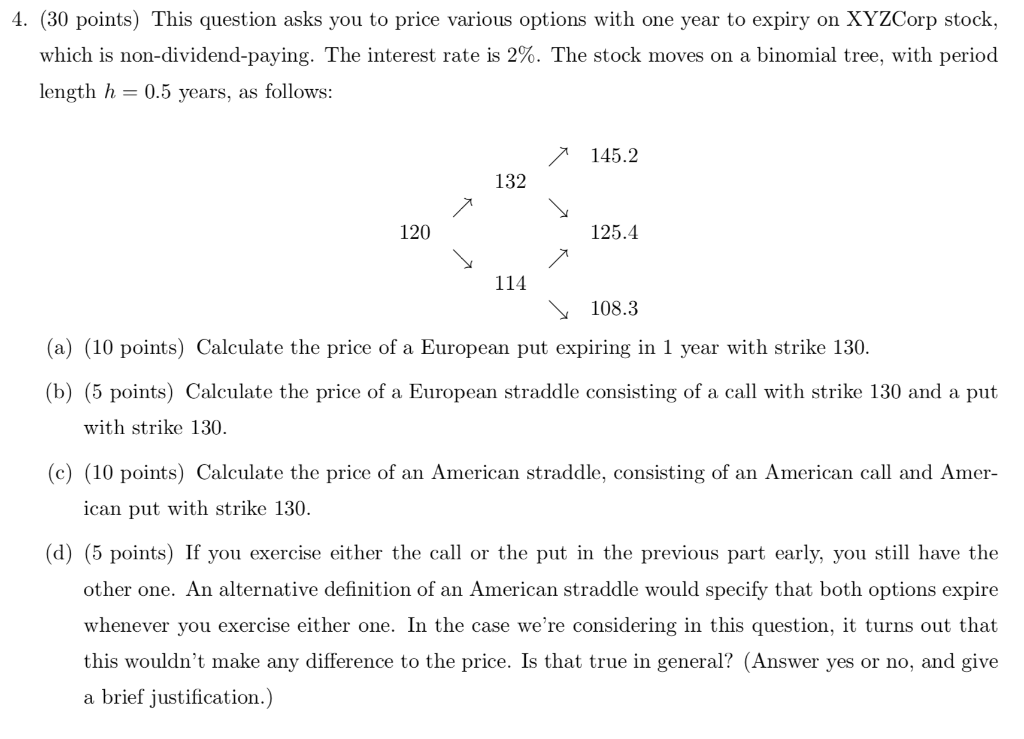

4. (30 points) This question asks you to price various options with one year to expiry on XYZCorp stock, which is non-dividend-paying. The interest rate is 2%. The stock moves on a binomial tree, with period length h = 0.5 years, as follows: 145.2 132 120 125.4 114 108.3 (a) (10 points) Calculate the price of a European put expiring in 1 year with strike 130. (b) (5 points) Calculate the price of a European straddle consisting of a call with strike 130 and a put with strike 130. (c) (10 points) Calculate the price of an American straddle, consisting of an American call and Amer- ican put with strike 130. (d) (5 points) If you exercise either the call or the put in the previous part early, you still have the other one. An alternative definition of an American straddle would specify that both options expire whenever you exercise either one. In the case we're considering in this question, it turns out that this wouldn't make any difference to the price. Is that true in general? (Answer yes or no, and give a brief justification.)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts