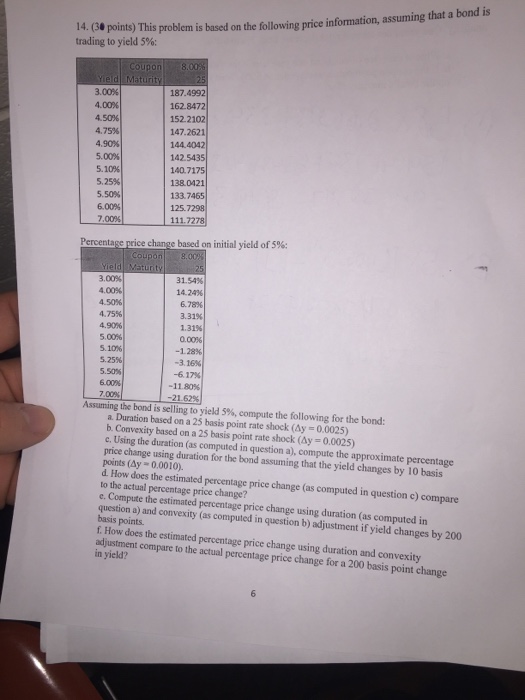

Question: 4. (3e points) This problem is based on the following price information, assuming that a bond is trading to yield 5%; 187.4992 162.8472 152.2102 147.2621

4. (3e points) This problem is based on the following price information, assuming that a bond is trading to yield 5%; 187.4992 162.8472 152.2102 147.2621 144.4042 142.5435 140.7175 138.0421 133.7465 25.7298 3.00% 4.00% 4.50% 4.75% 4.90% 5.00% 5.10% 5.25% 5.50% 6.00% 7.009% Percentage price change based on initial yield of 5%; 3.00% 4.00 4.50% 4.75%) 4.90% 5.00% 5.10% 31.54% 14.24% 678% 3.31% 1.31% 0.00% -3.16% -617% -11.80% -21.62% 7.00 Assuming ihe bond is selling to yield 5%, compute the following for the bond: a. Duration based on a 25 basis point rate shock (Ay 0.0025) b Convexity based on a 25 basis point rate shock (Ay = 0.0025) c. Using the duration (as computed in question a), compute the approximate percentage price change using duration for the bond assuming that the yield changes by 10 basis points (Ay 0.0010). d How does the estimated percentage price change (as computed in question e) compare to the actual percentage price change? e. Compute the estimated percentage price change using duration (as computed in question a) and convexity (as computed in question b) adjustment if yield changes by 200 basis points f. How does the estimated percentage price change using duration and convexity adjustment compare to the actual percentage price change for a 200 basis point change in yield

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts