Question: 4 4. Sweet Surrender Inc. is considering a project with the following cash flows.. a. Sweet Surrender has a policy of rejecting all projects that

4

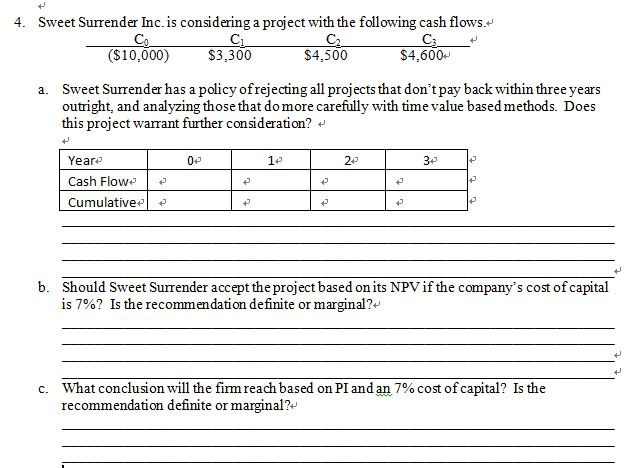

4. Sweet Surrender Inc. is considering a project with the following cash flows.. a. Sweet Surrender has a policy of rejecting all projects that don't pay back within three years outright, and analyzing those that do more carefully with time value based methods. Does this project warrant further consideration?.? b. Should Sweet Surrender accept the project based on its NPV if the company?s cost of capital is 7%? Is the recommendation definite or marginal?. c. What conclusion will the firm reach based on PI and an 7% cost of capital? ?s the recommendation definite or marginal

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock