Question: 4. (45 points) Mark, Pete and Mickey are equal partners in the 2MP Partnership. At the beginning of the year, Mark's basis in his partnership

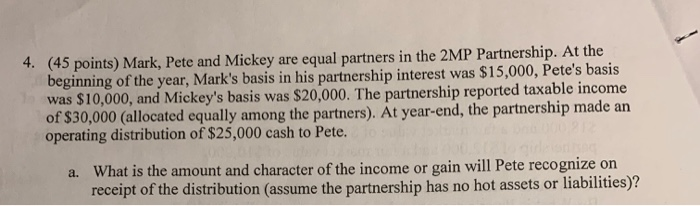

4. (45 points) Mark, Pete and Mickey are equal partners in the 2MP Partnership. At the beginning of the year, Mark's basis in his partnership interest was $15,000, Pete's basis was $10,000, and Mickey's basis was $20,000. The partnership reported taxable income of $30,000 (allocated equally among the partners). At year-end, the partnership made an operating distribution of $25,000 cash to Pete. a. What is the amount and character of the income or gain will Pete recognize on receipt of the distribution (assume the partnership has no hot assets or liabilities)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts