Question: PLEASE ONLY DO PART C 6 - 1 The working paper elimination for Pakistan Corporation and subsidiary on March 3 1 . Year 7 .

PLEASE ONLY

DO PART C

The working paper elimination for Pakistan Corporation and subsidiary on March Year the date of the purchasetype business combination, was as follows:

a Common Stock. parSikkim

Paidin Capital in Excess of ParSikkim

Retained EarningsSikkim

InventoriesSikkim fifo cost

LandSikkim

Other Plant AssetsSikkim economic life years

GoodwillSikkim

Investment in Sikkim Company Common Stock

Pakistan

To eliminate intercompany investment and equity accounts of subsidiary on date of business combination; and to allocate excess of cost over carrying amounts of identifiable assets acquired, with remainder to goodwill. Income tax effects are disregarded.

For the fiscal year ended March Year Sikkim Comoany reported net income of $ Sikkim declared a cash dividend of $ a share on March Year and paid the dividend on Marcn Year Sikkim had not declared or paid dividends during the year ended Marcn Year Sikkim uses the straightline method for depreciation expense and amortization expense. both of which are included in operating expenses.

Instructions

a Prepare journal entries in the accounting records of Pakistan Corporation to record the operating results of Sikkim Company for the year ended March Year under the equity method of accounting. Disregard income taxes.

b Prepare threecolumn ledger accounts for Pakistan Corporation's Investment in Sikkim Company Common Stock and Intercompany Investment Income accounts, and post the journal entries in a

c Prepare a working paper elimination for Pakistan Corporation and subsidiary on March Year in journal entry form. Disregard income taxes.

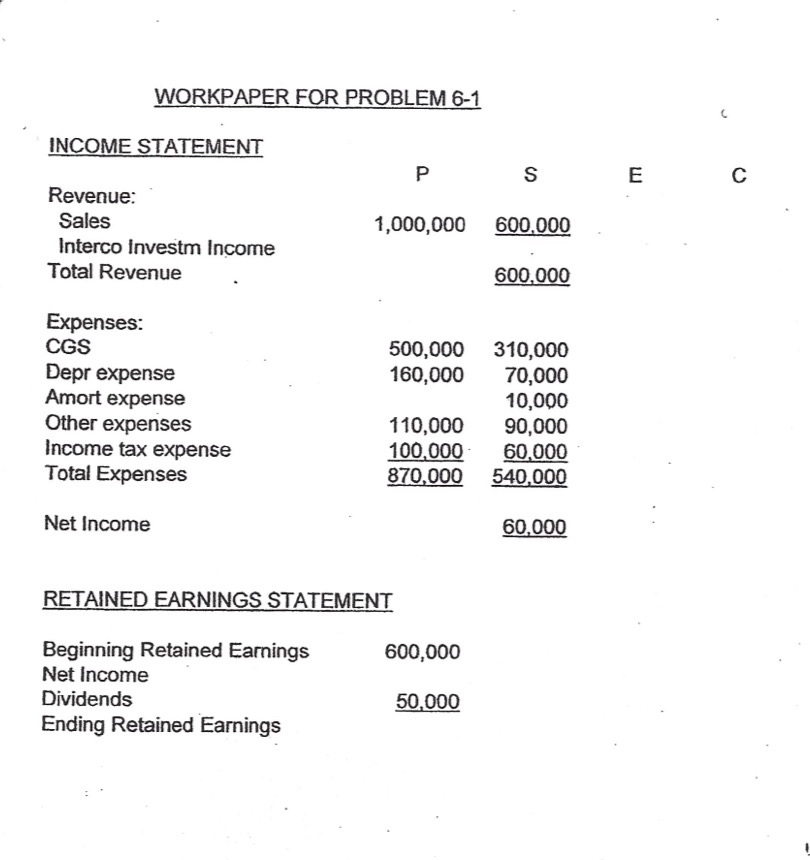

WORKPAPER FOR PROBLEM

INCOME STATEMENT

tableRevenue:PStableSalesInterco Investm Income The working paper elimination for Pakistan Corporation and subsidiary on March Year the date of the purchasetype business combination, was as follows:

a Common Stock. parSikkim

Paidin Capital in Excess of ParSikkim

Retained EarningsSikkim

InventoriesSikkim fifo cost

LandSikkim

Other Plant AssetsSikkim economic life years

GoodwillSikkim

Investment in Sikkim Company Common Stock

Pakistan

To eliminate intercompany investment and equity accounts of subsidiary on date of business combination; and to allocate excess of cost over carrying amounts of identifiable assets acquired, with remainder to goodwill. Income tax effects are disregarded.

For the fiscal year ended March Year Sikkim Comoany reported net income of $ Sikkim declared a cash dividend of $ a share on March Year and paid the dividend on Marcn Year Sikkim had not declared or paid dividends during the year ended Marcn Year Sikkim uses the straightline method for depreciation expense and amortization expense. both of which are included in operating expenses.

Instructions

a Prepare journal entries in the accounting records of Pakistan Corporation to record the operating results of Sikkim Company for the year ended March Year under the equity method of accounting. Disregard income taxes.

b Prepare threecolumn ledger accounts for Pakistan Corporation's Investment in Sikkim Company Common Stock and Intercompany Investment Income accounts, and post the journal entries in

WORKPAPER FOR PROBLEM

INCOME STATEMENT

RETAINED EARNINGS STATEMENT

Beginning Retained Earnings

Net Income

Dividends

Ending Retained Earnings

c Prepare a working paper limination for Pakistan Corporation and subsidiary on March Year in journal entry form. Disregard income taxes.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock